Question: Post the journal entries for all the preceding transactions. Export a post-closing trial balance for 2023 to prepare a statement of fiduciary net position for

Post the journal entries for all the preceding transactions.

Post the journal entries for all the preceding transactions.

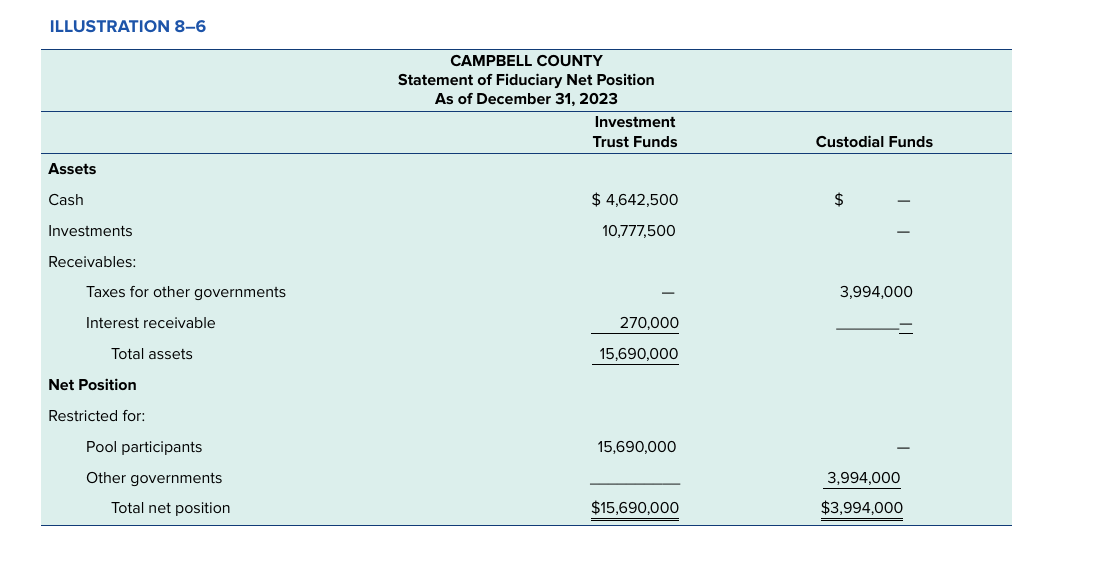

Export a post-closing trial balance for 2023 to prepare a statement of fiduciary net position for the Tax Custodial Fund (for an example of a custodial fund statement, see the last column of Illustration 8-6 of the textbook). You should deduct the citys General Fund portion of delinquent taxes receivable from the amounts recorded as Taxes Receivable for Other Funds and GovernmentsDelinquent. The citys General Fund portion of the account balance must be deducted as only the amounts applicable to other governments can be reported in a fiduciary fund statement. Similarly, the liability Due to Other Funds would not be included on the fiduciary net position. Taxes receivable that are applicable to the city itself were reported in the General Fund balance sheet that you prepared in Chapter 4 of this project.

Post-closing Trial Balance as of 2023 City of Smithville 7- Tax Custodial Fund \begin{tabular}{l|c|c|} \hline \multicolumn{1}{|c|}{ Description } & Debit & Credit \\ \hline Cash & 14,366,002 \\ Taxes Receivable for Other Funds and Governments-Current & 27,177,765 \\ Taxes Receivable for Other Funds and Governments-Delinquent & 1,878,921 \\ Due to Other Funds & 123,507 \\ Additions-Property Tax Collections for Other Governments & 14,690,684 \\ Deductions-Administrative Fee & 123,507 \\ \hline \hline Totals for all accounts & 29,180,193 & 29,180,193 \end{tabular} ILLUSTRATION 8-6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts