Question: Posted before and it was incorrect. Please help Attempts: 0 Average: 0/1.5 3. Problem 7-03 (Horizon Value of Free Cash Flows) eBook Horizon Value of

Posted before and it was incorrect. Please help

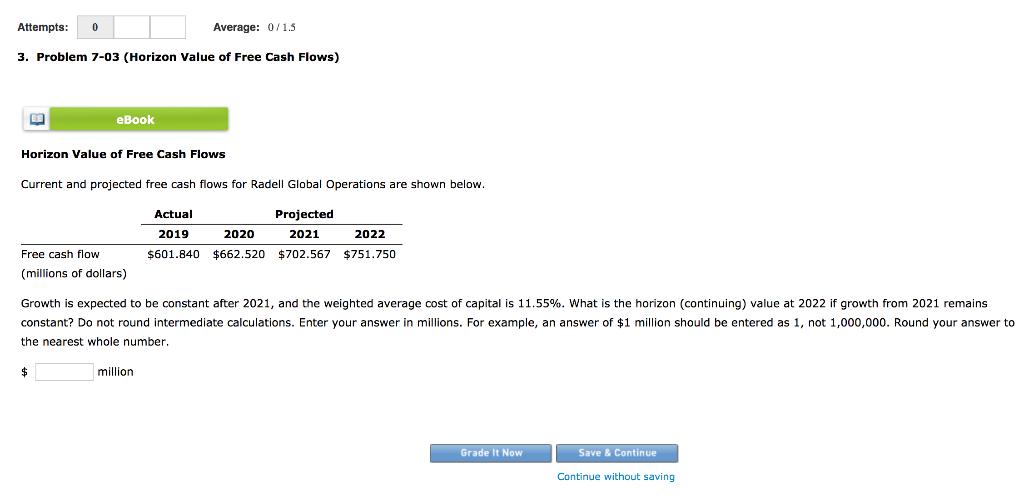

Attempts: 0 Average: 0/1.5 3. Problem 7-03 (Horizon Value of Free Cash Flows) eBook Horizon Value of Free Cash Flows Current and projected free cash flows for Radell Global Operations are shown below. Actual Projected 2019 2020 2021 2022 $601.840 $662.520 $702.567 $751.750 Free cash flow (millions of dollars) Growth is expected to be constant after 2021, and the weighted average cost of capital is 11.55%. What is the horizon (continuing) value at 2022 if growth from 2021 remains constant? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to the nearest whole number. million Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts