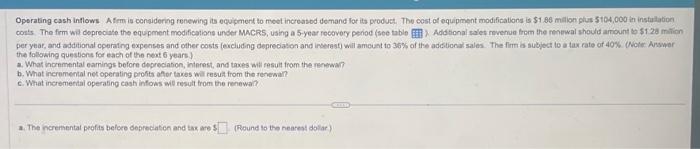

Question: posted question before and ot was wrong. please answer if you know its correct. (the following questions need answers for the next 6 years) Operating

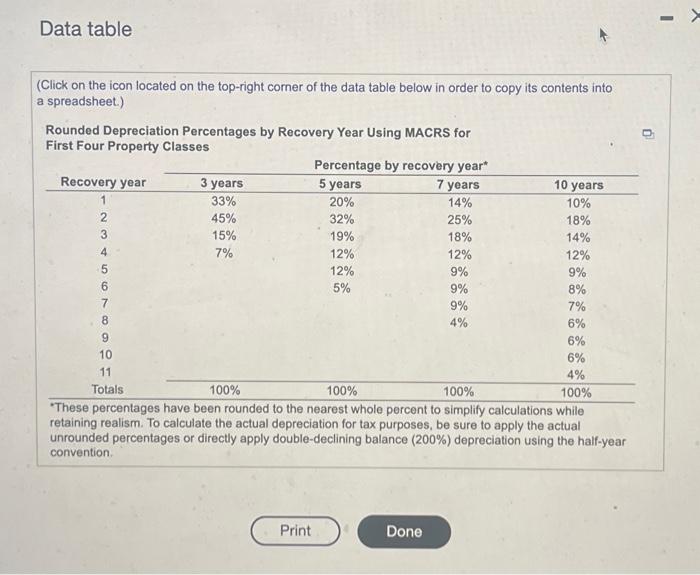

Operating cash inflows. Afme is considering renewing its equpment to meet incroasod demand lor its produet. The cost of equipment modifications is $1.85 malion plus 5 to4. 000 in instulation per year, and additional operaing expenses and other costs (excluding depreciaton and inserast wil ameuat to 36% of ife adibtional sales. The flim is subject to a tax rate of 40% ( Wote Answor the following questions for each of the next 6 years) a. What incremental eamings before degreciation, interest, and taxes wil sesult from the renewar? b. What incremental net operating profits afor tawes wil result from the ferewal? c. What incremertal operating cash infows wil result trom the renewa? a. The ncremental pefits belore deprocation and tax are ? (Found to the nearest dolar) Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Tnese percentages nave deen rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts