Question: Posting and Techniques for finding errors 1. For the following error situations, make correcting journal entries on the journal paper provided in your Workbook. Explanations

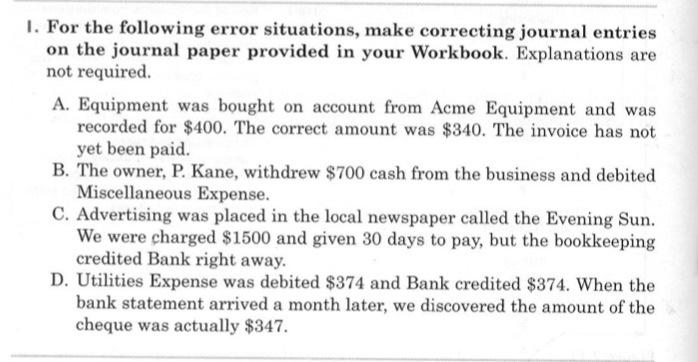

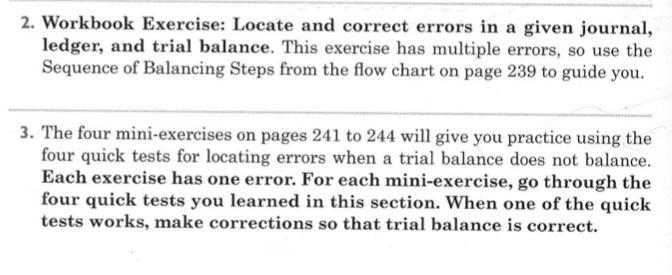

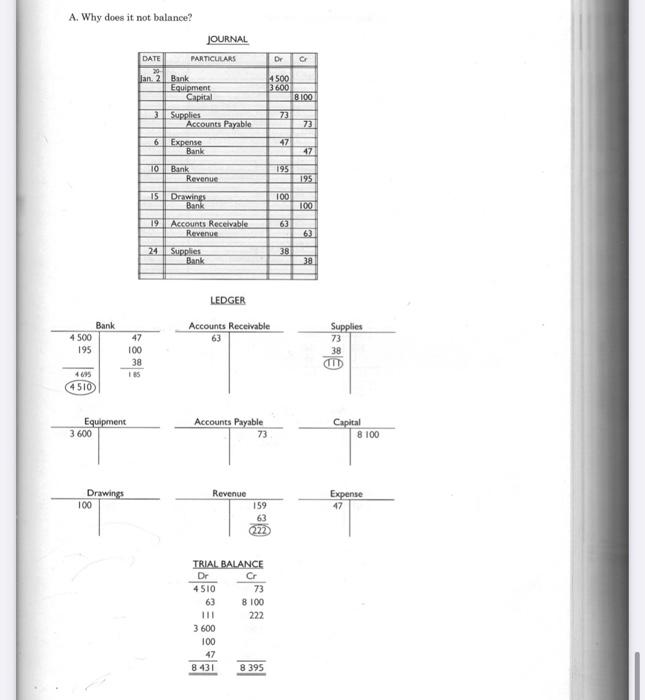

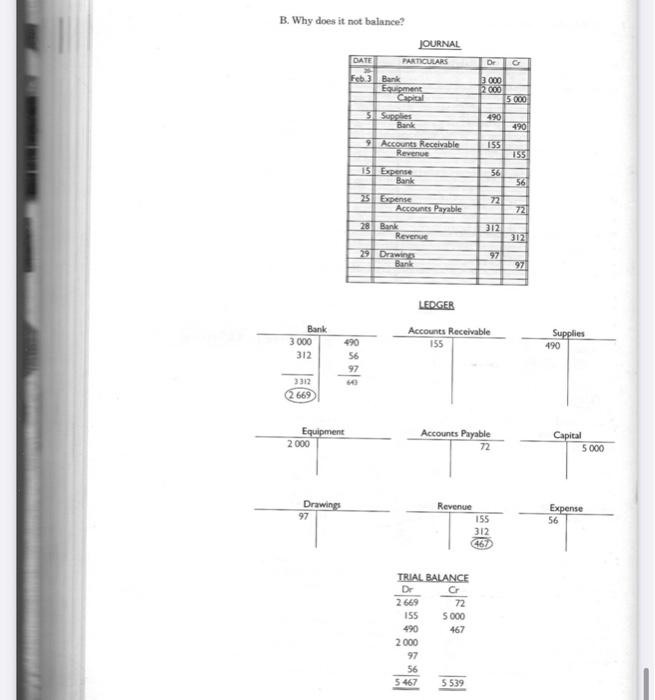

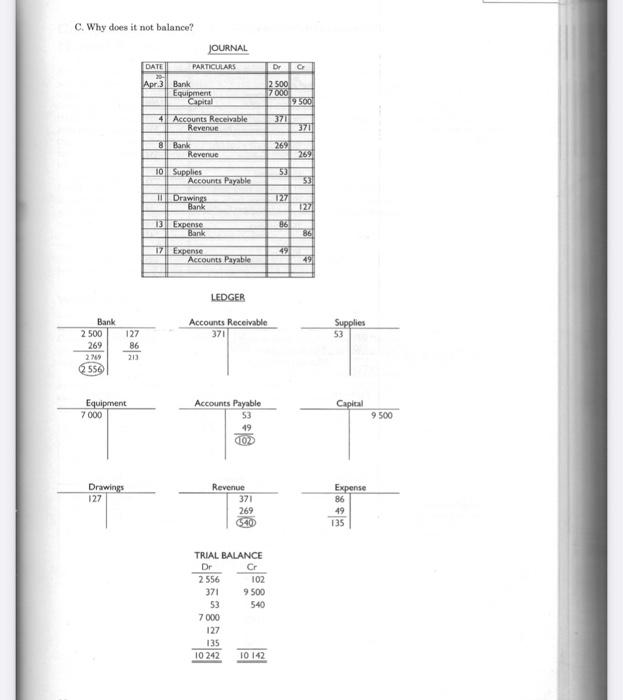

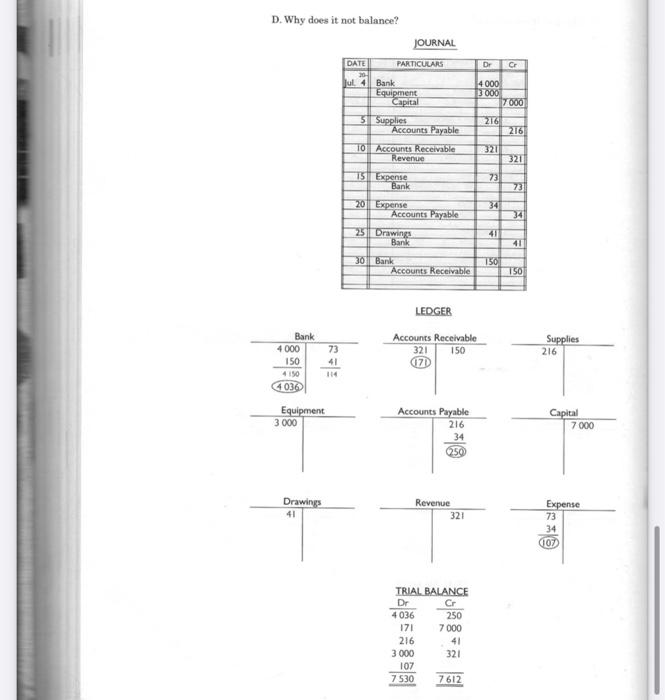

1. For the following error situations, make correcting journal entries on the journal paper provided in your Workbook. Explanations are not required. A. Equipment was bought on account from Acme Equipment and was recorded for $400. The correct amount was $340. The invoice has not yet been paid. B. The owner, P. Kane, withdrew $700 cash from the business and debited Miscellaneous Expense. C. Advertising was placed in the local newspaper called the Evening Sun. We were charged $1500 and given 30 days to pay, but the bookkeeping credited Bank right away. D. Utilities Expense was debited $374 and Bank credited $374. When the bank statement arrived a month later, we discovered the amount of the cheque was actually $347. 2. Workbook Exercise: Locate and correct errors in a given journal, ledger, and trial balance. This exercise has multiple errors, so use the Sequence of Balancing Steps from the flow chart on page 239 to guide you. 3. The four mini-exercises on pages 241 to 244 will give you practice using the four quick tests for locating errors when a trial balance does not balance. Each exercise has one error. For each mini-exercise, go through the four quick tests you learned in this section. When one of the quick tests works, make corrections so that trial balance is correct. A. Why does it not balance? DATE 20 Jan. 2 Bank 4.500 195 4695 (4510) 3.600 47 100 38 185 Equipment Drawings 100 JOURNAL PARTICULARS Bank Equipment Capital 3 Supplies 6 Expense Bank 10 Bank Revenue 15 Drawings Bank 19 Accounts Receivable Revenue 24 Supplies Bank LEDGER Accounts Receivable 63 Accounts Payable 73 Revenue 159 63 2222 TRIAL BALANCE Dr Cr 4510 63 111 3 600 100 47 8.431 Accounts Payable Dr 4.500 3600 73 47 195 100 63 38 73 8 100 222 8 395 Cr 8.100 73 47 195 100 63 38 Supplies 73 38 D Capital 8 100 Expense 47 B. Why does it not balance? DATE Feb 3 Bank Equipment Capital 5 Supplies Bank 9 Accounts Receivable Revenue 15 Expense Bank 25 Expense Accounts Payable 28 Bank Revenue Bank 3000 312 3312 (2669 490 56 97 Equipment Drawings 97 2.000 JOURNAL PARTICULARS Drawing Bank Dr 3 000 12 000 490 155 56 72 312 97 LEDGER Accounts Receivable 155 Accounts Payable 72 Revenue TRIAL BALANCE Dr Cr 2669 155 490 2000 97 56 5467 72 5 000 467 5:539 155 312 467 G 5 000 490 155 56 72 312 97 Supplies 490 Capital 5.000 Expense 56 C. Why does it not balance? DATE Apr.3 Bank Bank 2500 269 127 86 213 2769 (2556) Equipment 7.000 Drawings 127 JOURNAL PARTICULARS Equipment Capital 4 Accounts Receivable Revenue 8 Bank Revenue 10 Supplies Accounts Payable Accounts Payable LEDGER Accounts Receivable 371 Accounts Payable 53 49 102 Drawings Bank 13 Expense Bank 17 Expense Revenue 371 269 540 TRIAL BALANCE Dr Cr 2556 371 53 7000 127 10242 102 9 500 540 10 142 Dr C 2 500 7000 371 269 53 127 86 49 9.500 371 269 53 127 86 49 Supplies 53 Capital Expense 86 49 135 9500 D. Why does it not balance? DATE Jul 4 Bank 4 000 150 4150 4036 Equipment 3 000 Drawings 41 73 41 114 JOURNAL PARTICULARS Bank Equipment Capital 5 Supplies Accounts Payable 10 Accounts Receivable Revenue 15 Expense Bank 20 Expense Accounts Payable 25 Drawings Bank 30 Bank Accounts Receivable LEDGER Accounts Receivable 321 150 170 Accounts Payable 216 34 250 Revenue 321 TRIAL BALANCE Dr Cr 4036 171 216 3 000 107 7530 250 7000 41 321 7612 Dr Cr 4 000 3 000 216 321 73 41 150 7.000 216 321 73 34 41 150 Supplies 216 Capital 7 000 Expense 73 34 (107)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts