Question: Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance columns (debit and

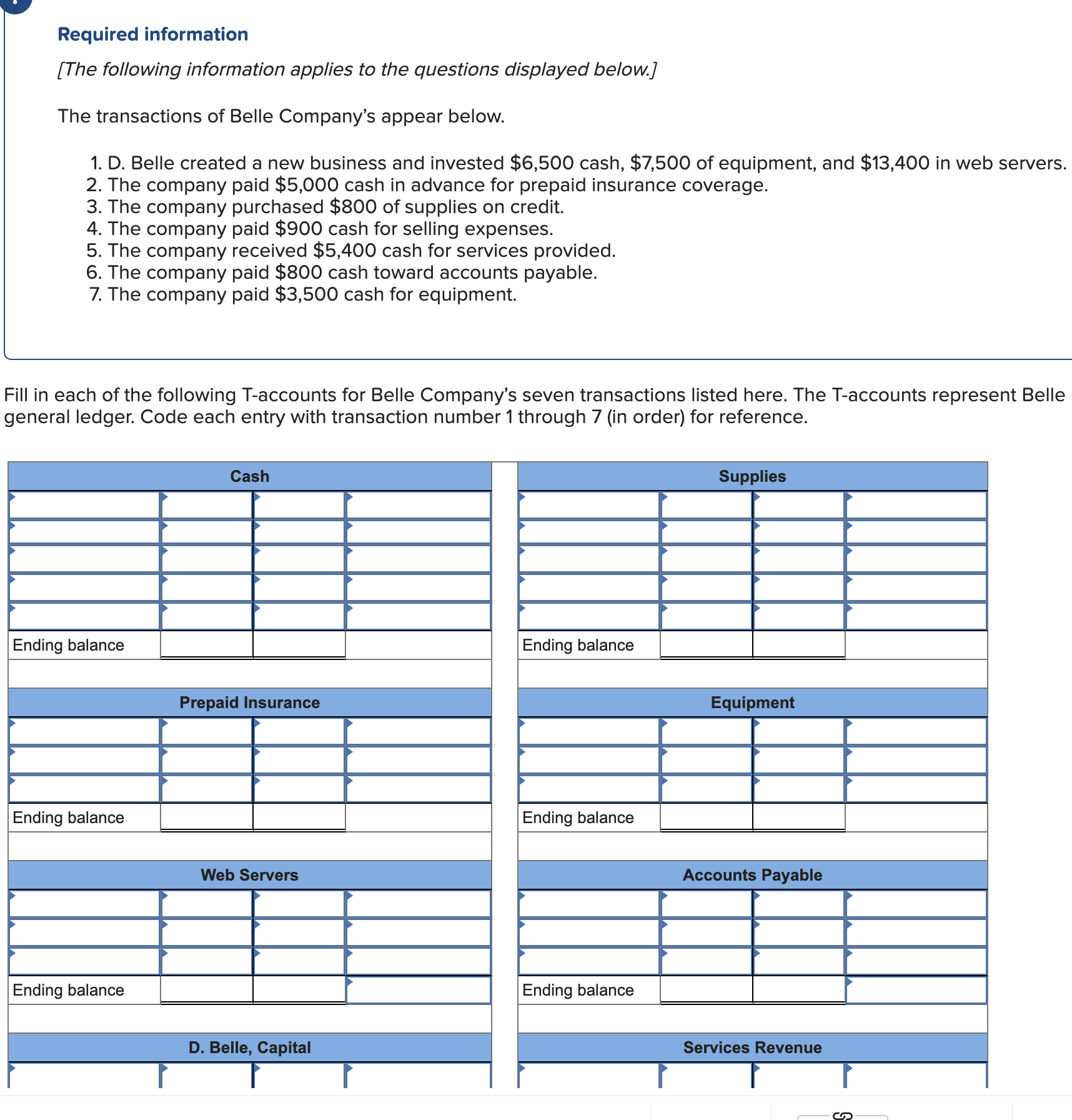

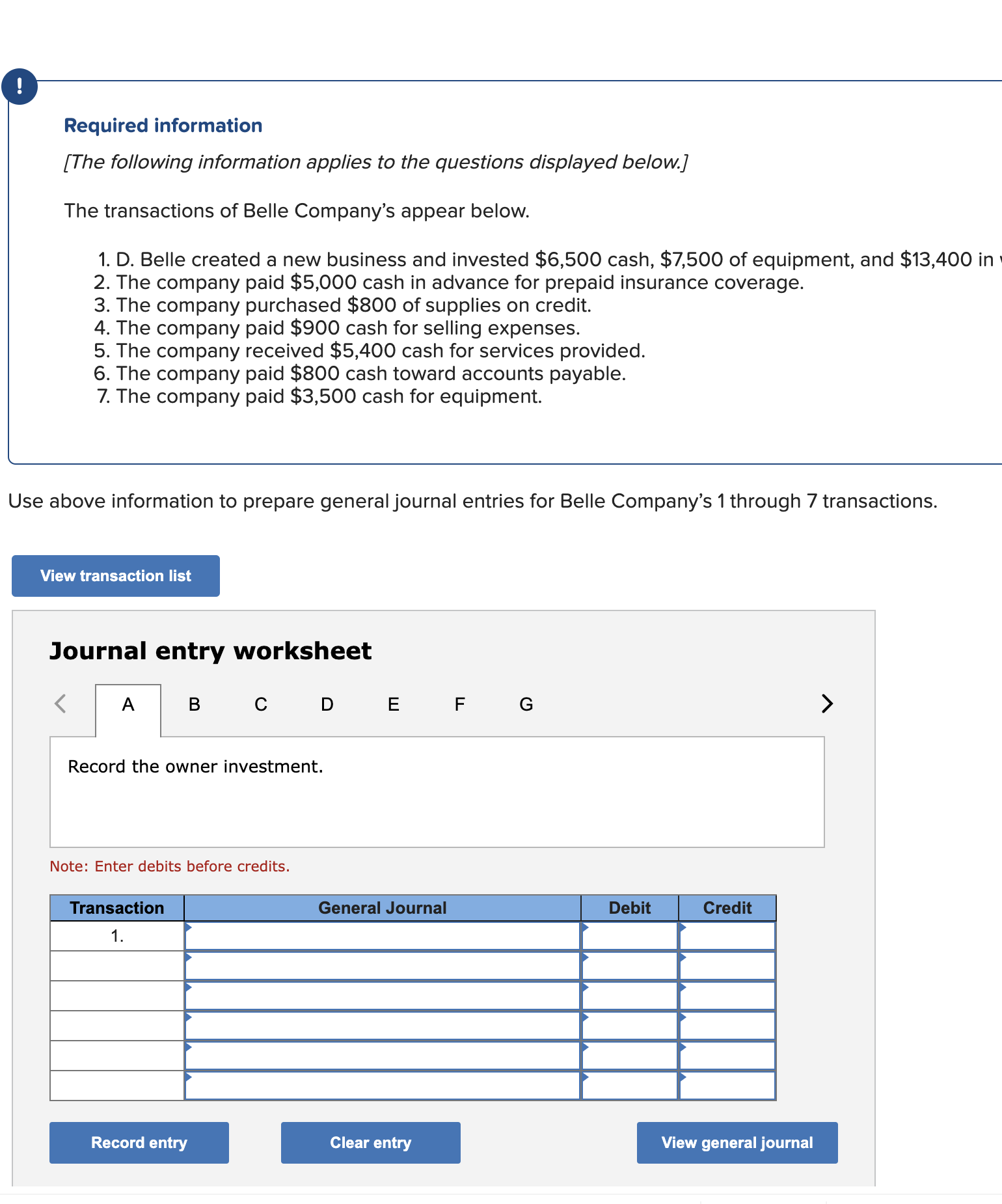

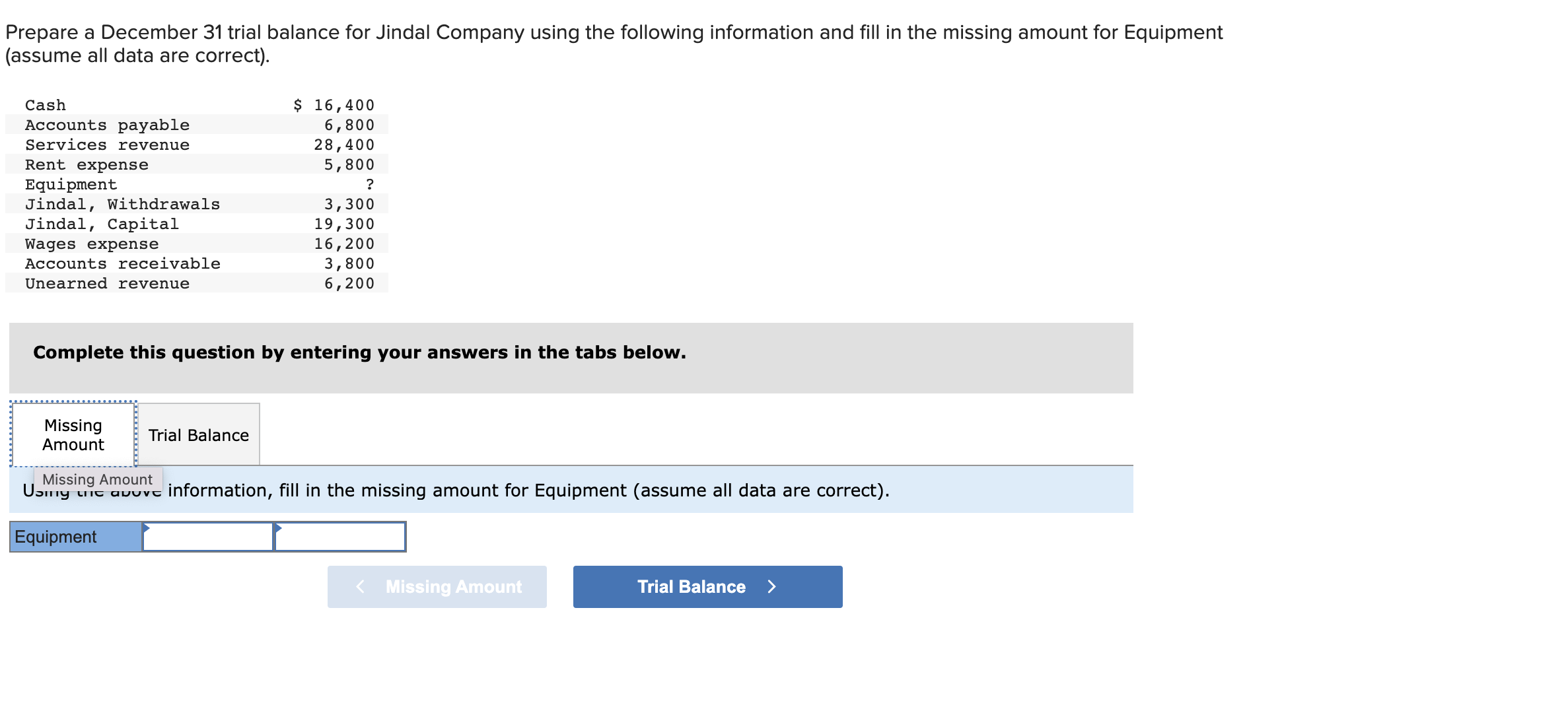

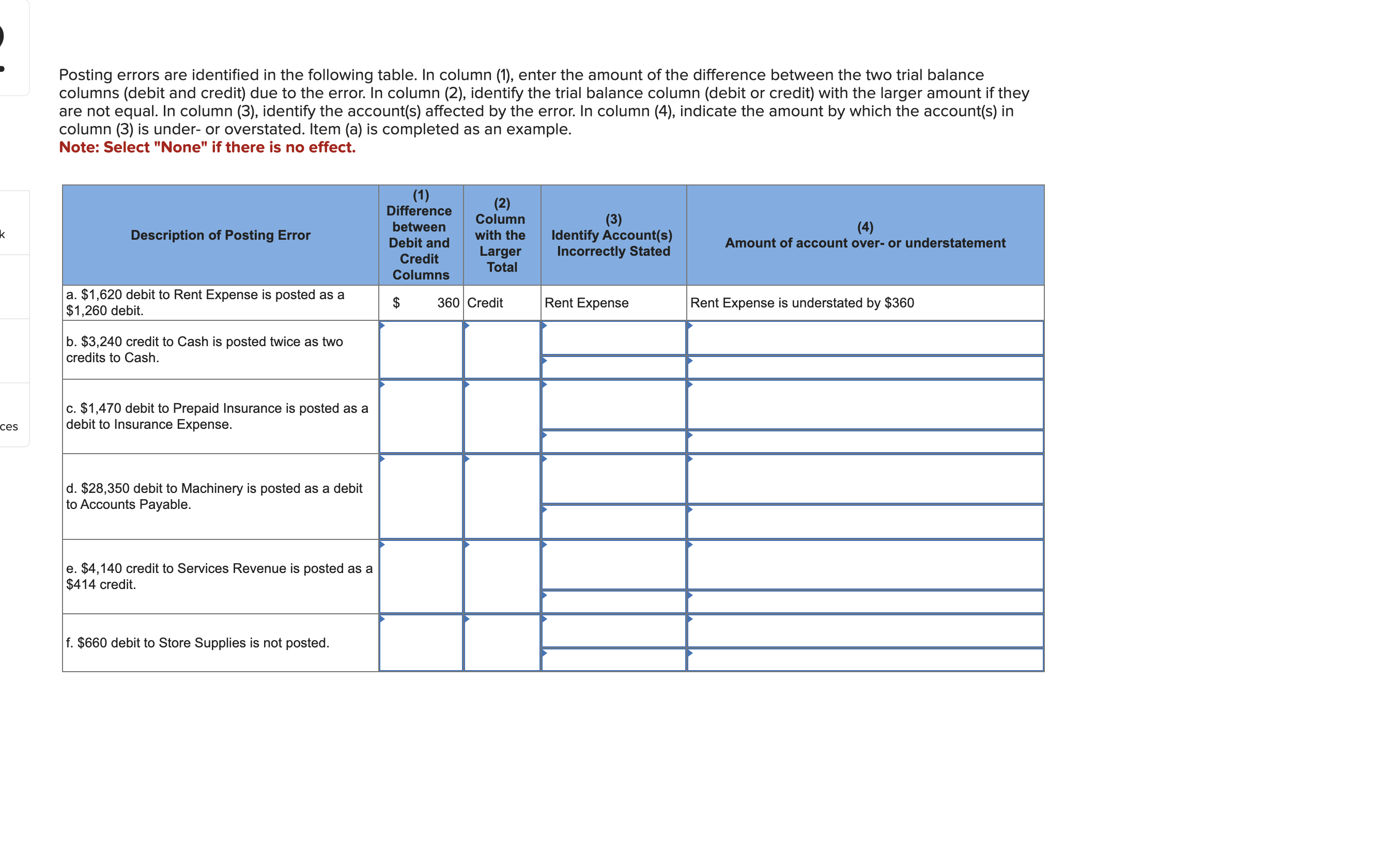

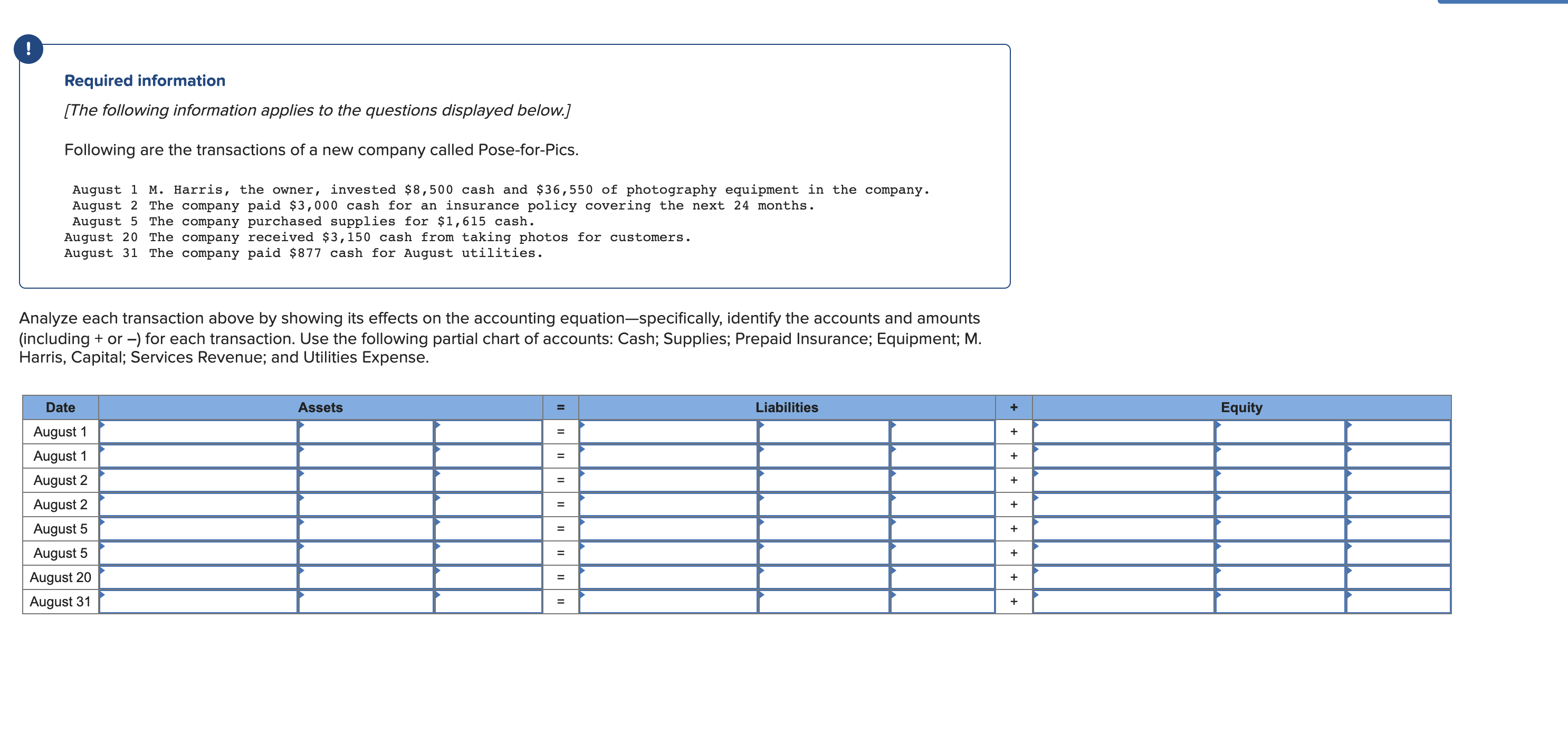

Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in column (3) is under- or overstated. Item (a) is completed as an example. Note: Select "None" if there is no effect. Prepare a December 31 trial balance for Jindal Company using the following information and fill in the missing amount for Equipmen assume all data are correct). Complete this question by entering your answers in the tabs below. Missing Amount Missing Amount information, fill in the missing amount for Equipment (assume all data are correct). Required information [The following information applies to the questions displayed below.] The transactions of Belle Company's appear below. 1. D. Belle created a new business and invested $6,500 cash, $7,500 of equipment, and $13,400 in 2. The company paid $5,000 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on credit. 4. The company paid $900 cash for selling expenses. 5. The company received $5,400 cash for services provided. 6 . The company paid $800 cash toward accounts payable. 7. The company paid $3,500 cash for equipment. Use above information to prepare general journal entries for Belle Company's 1 through 7 transactions. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner, invested $8,500 cash and $36,550 of photography equipment in the company. August 2 The company paid $3,000 cash for an insurance policy covering the next 24 months. August 5 The company purchased supplies for $1,615 cash. August 20 The company received $3,150 cash from taking photos for customers. August 31 The company paid $877 cash for August utilities. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction. Use the following partial chart of accounts: Cash; Supplies; Prepaid Insurance; Equipment; M. Harris, Capital; Services Revenue; and Utilities Expense. Required information [The following information applies to the questions displayed below.] The transactions of Belle Company's appear below. 1. D. Belle created a new business and invested $6,500 cash, $7,500 of equipment, and $13,400 in web servers. 2 . The company paid $5,000 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on credit. 4. The company paid $900 cash for selling expenses. 5 . The company received $5,400 cash for services provided. 6 . The company paid $800 cash toward accounts payable. 7. The company paid $3,500 cash for equipment. Fill in each of the following T-accounts for Belle Company's seven transactions listed here. The T-accounts represent Belle yeneral ledger. Code each entry with transaction number 1 through 7 (in order) for reference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts