Question: Posting here again bc they got this answer wrong. The answer for cost of debt so far IS NOT : 2.67%, 5.52%, 3.17%, 3.06%, 3.36%...

Posting here again bc they got this answer wrong. The answer for cost of debt so far IS NOT: 2.67%, 5.52%, 3.17%, 3.06%, 3.36%... Please help. I included the Chegg answers WRONG answer so that the same person does not solve it the same way again. Chegg is down and cannot post comments right now or else I would have done it there. It is a hassle to email Chegg so please try ur best

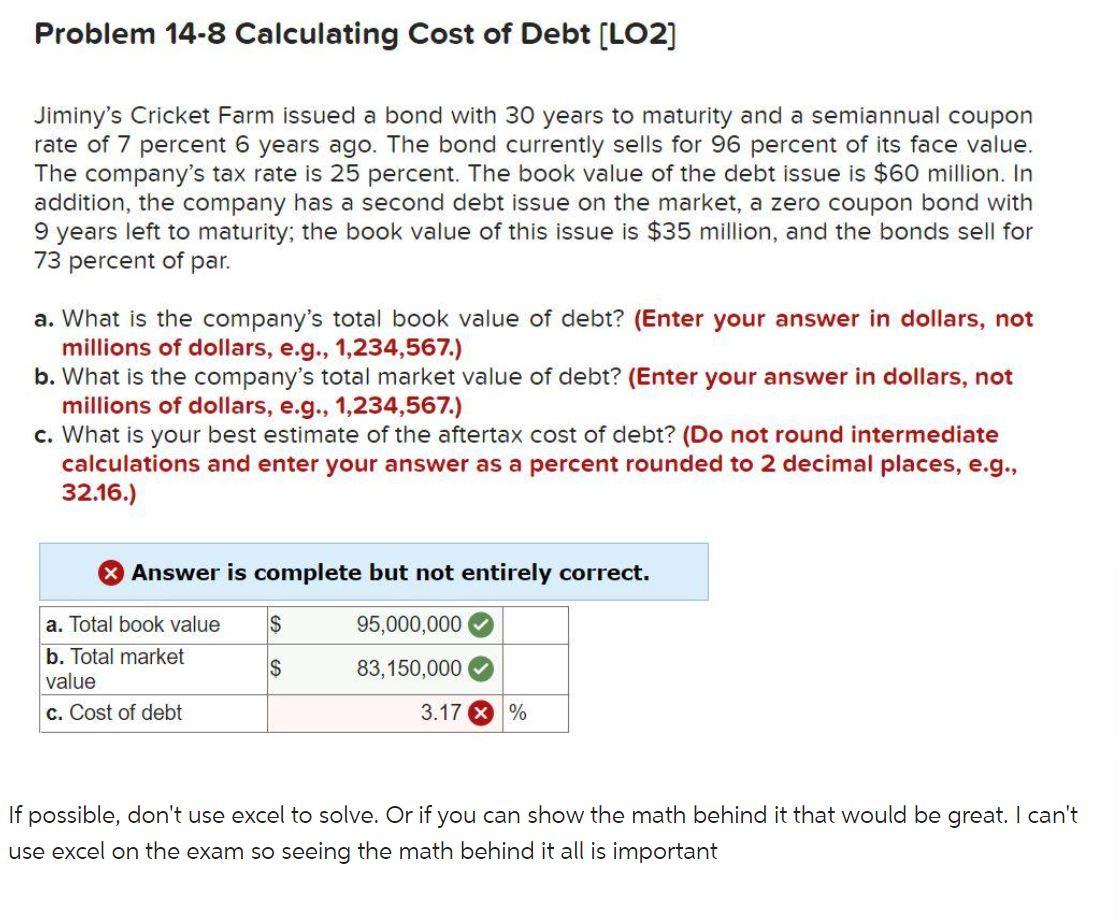

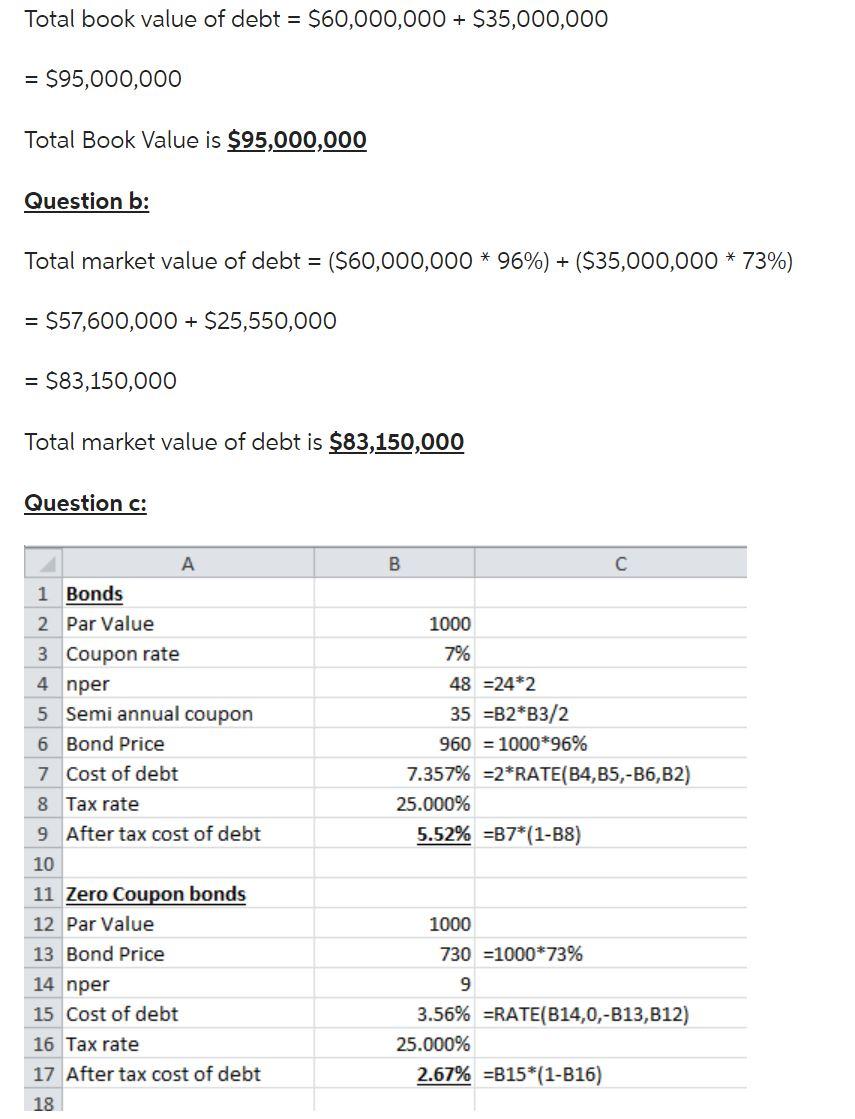

Problem 14-8 Calculating Cost of Debt [LO2] Jiminy's Cricket Farm issued a bond with 30 years to maturity and a semiannual coupon rate of 7 percent 6 years ago. The bond currently sells for 96 percent of its face value. The company's tax rate is 25 percent. The book value of the debt issue is $60 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 9 years left to maturity; the book value of this issue is $35 million, and the bonds sell for 73 percent of par. a. What is the company's total book value of debt? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) b. What is the company's total market value of debt? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) c. What is your best estimate of the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent roun ed to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. S 95,000,000 a. Total book value b. Total market value c. Cost of debt $ 83,150,000 3.17 X % If possible, don't use excel to solve. Or if you can show the math behind it that would be great. I can't use excel on the exam so seeing the math behind it all is important Total book value of debt = $60,000,000 + $35,000,000 = $95,000,000 Total Book Value is $95,000,000 Question b: Total market value of debt = ($60,000,000 * 96%) + ($35,000,000 * 73%) = $57,600,000 + $25,550,000 = $83,150,000 Total market value of debt is $83,150,000 Question c: A B C 1 Bonds 2 Par Value 3 Coupon rate 4 nper 5 Semi annual coupon 6 Bond Price 7 Cost of debt 8 Tax rate 9 After tax cost of debt 1000 7% 48 =24*2 35 =B2*B3/2 960 = 1000*96% 7.357% =2*RATE(B4,B5,-B6, B2) 25.000% 5.52% =37*(1-08) 10 11 Zero Coupon bonds 12 Par Value 13 Bond Price 14 nper 1000 730 = 1000*73% 9 3.56% =RATE(B14,0,-B13,B12) 25.000% 2.67% =B15*(1-B16) 15 Cost of debt 16 Tax rate 17 After tax cost of debt 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts