Question: posting this question twice as to get the second and third parts answered to that follow the first one to follow guidlines. please help! Assume

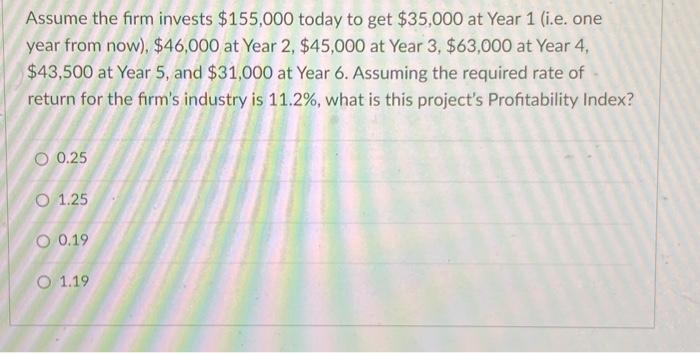

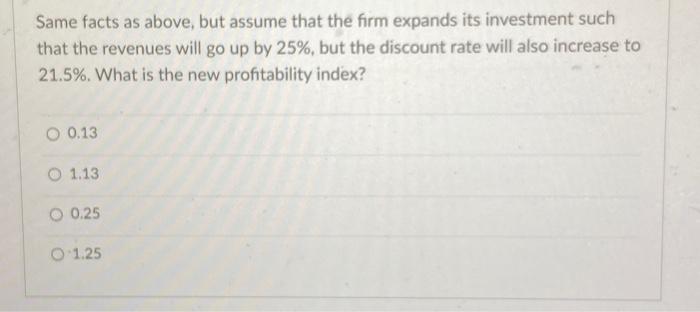

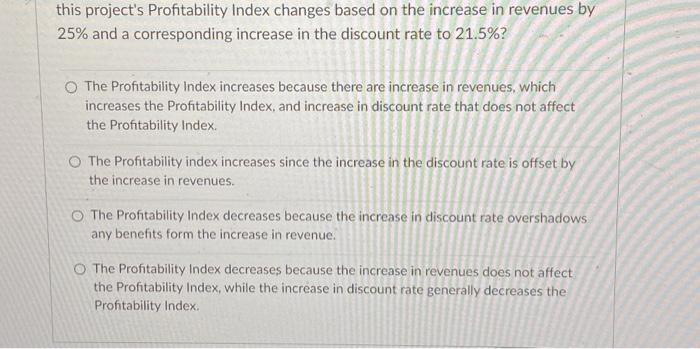

Assume the firm invests $155,000 today to get $35,000 at Year 1 (i.e. one year from now), $46,000 at Year 2,$45,000 at Year 3,$63,000 at Year 4 , $43,500 at Year 5 , and $31,000 at Year 6. Assuming the required rate of return for the firm's industry is 11.2%, what is this project's Profitability Index? 0.25 1.25 0.19 1.19 Same facts as above, but assume that the firm expands its investment such that the revenues will go up by 25%, but the discount rate will also increase to 21.5%. What is the new profitability index? 0.13 1.13 0.25 1.25 this project's Profitability Index changes based on the increase in revenues by 25% and a corresponding increase in the discount rate to 21.5% ? The Profitability Index increases because there are increase in revenues, which increases the Profitability Index, and increase in discount rate that does not affect the Profitability Index. The Profitability index increases since the increase in the discount rate is offset by the increase in revenues. The Profitability Index decreases because the increase in discount rate overshadows any benefits form the increase in revenue. The Profitability Index decreases because the increase in revenues does not affect the Profitability Index, while the increase in discount rate generally decreases the Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts