Question: Pound Spot Rate in 1 Year Exercise Scenario Probability Option Premium Total Price Per Unit, with Premium Total Price Paid for 100,000 Pounds Options? 1

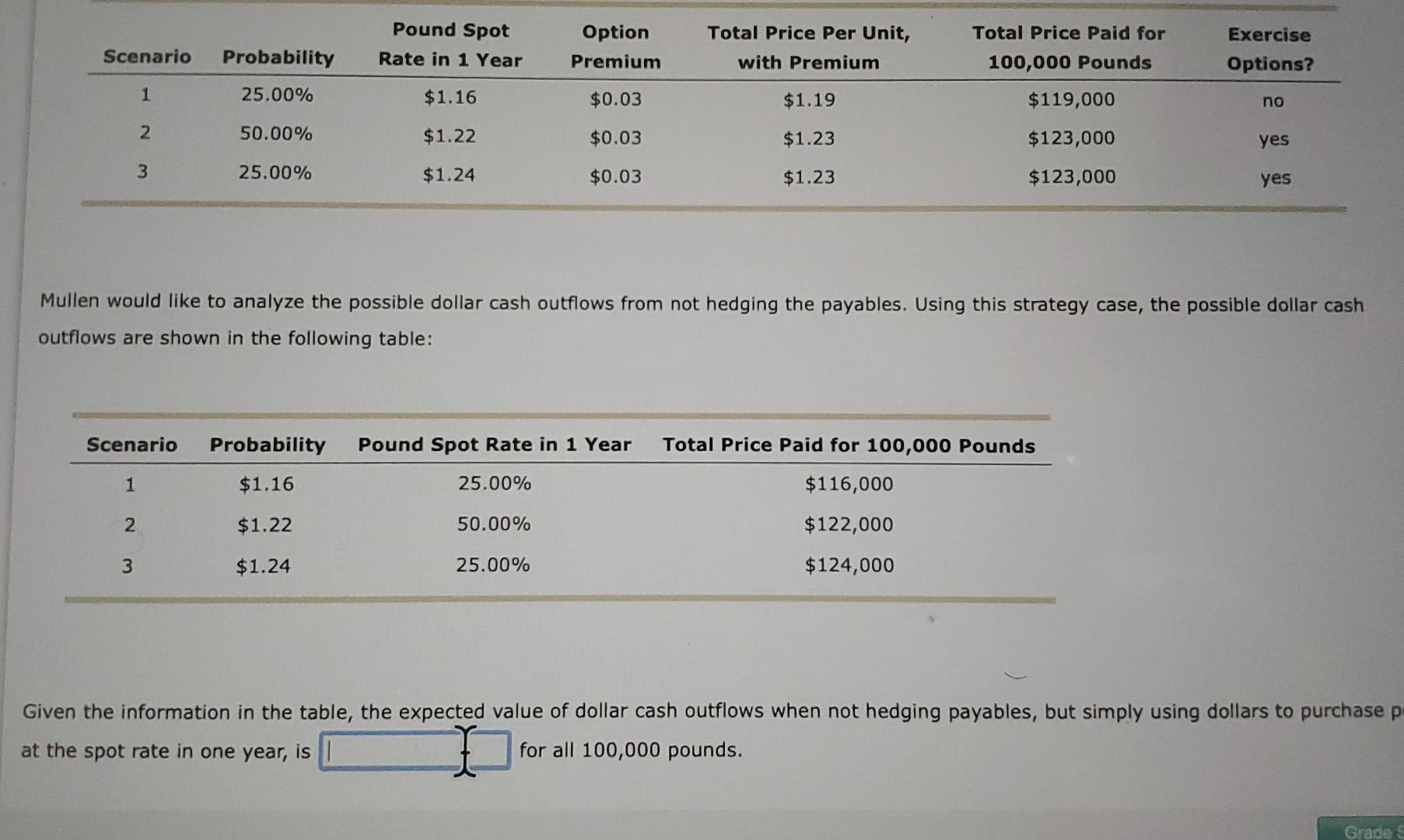

Pound Spot Rate in 1 Year Exercise Scenario Probability Option Premium Total Price Per Unit, with Premium Total Price Paid for 100,000 Pounds Options? 1 25.00% $1.16 $0.03 $1.19 $119,000 no 2 50.00% $1.22 $0.03 $1.23 $123,000 yes 3 25.00% $1.24 $0.03 $1.23 $123,000 yes Mullen would like to analyze the possible dollar cash outflows from not hedging the payables. Using this strategy case, the possible dollar cash outflows are shown in the following table: Scenario Probability Pound Spot Rate in 1 Year Total Price Paid for 100,000 Pounds 1 $1.16 25.00% $116,000 2 $1.22 50.00% $122,000 3 $1.24 25.00% $124,000 Given the information in the table, the expected value of dollar cash outflows when not hedging payables, but simply using dollars to purchase p at the spot rate in one year, is for all 100,000 pounds. I Grades

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts