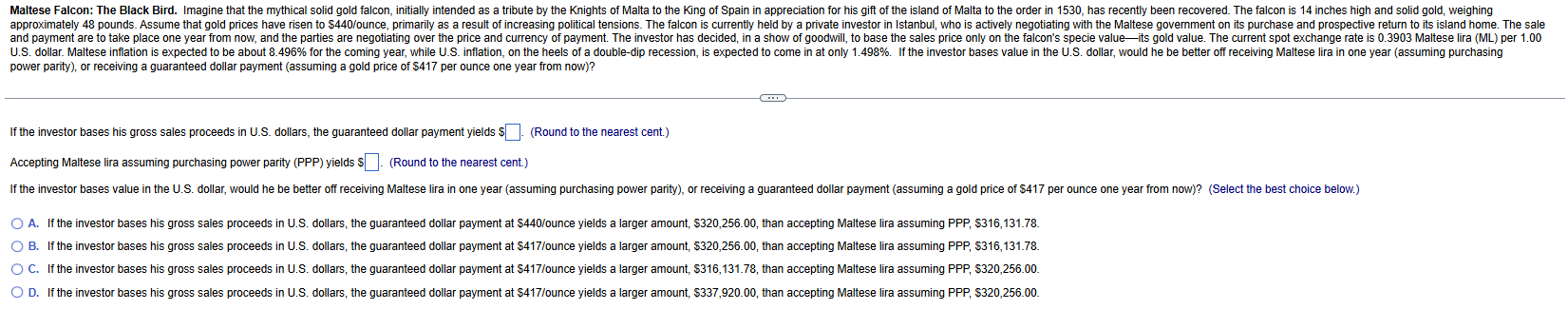

Question: power parity ) , or receiving a guaranteed dollar payment ( assuming a gold price of $ 4 1 7 per ounce one year from

power parity or receiving a guaranteed dollar payment assuming a gold price of $ per ounce one year from now

If the investor bases his gross sales proceeds in US dollars, the guaranteed dollar payment yields $

Round to the nearest cent.

Accepting Maltese lira assuming purchasing power parity PPP yields Round to the nearest ce

A If the investor bases his gross sales proceeds in US dollars, the guaranteed dollar payment at $ounce yields a larger amount, $ than accepting Maltese lira assuming PPP $

B If the investor bases his gross sales proceeds in US dollars, the guaranteed dollar payment at $ ounce yields a larger amount, $ than accepting Maltese lira assuming PPP $

C If the investor bases his gross sales proceeds in US dollars, the guaranteed dollar payment at $ ounce yields a larger amount, $ than accepting Maltese lira assuming PPP $

D If the investor bases his gross sales proceeds in US dollars, the guaranteed dollar payment at $ ounce yields a larger amount, $ than accepting Maltese lira assuming PPP $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock