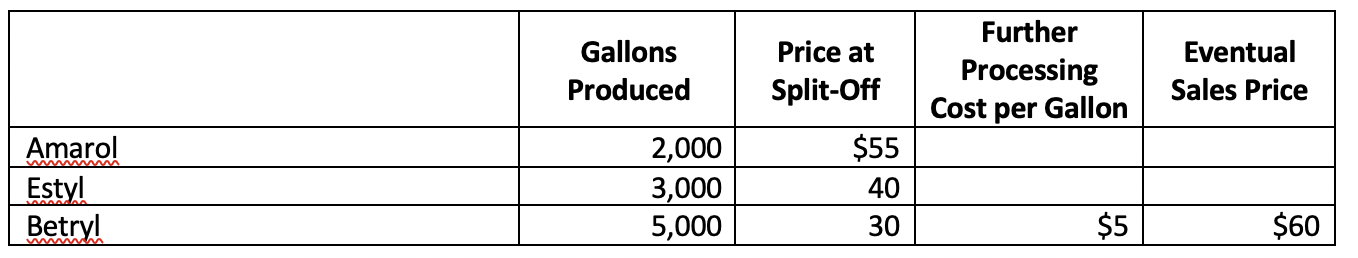

Question: PP Company purchases a material that is then processed to yield three chemicals: anarol, estyl, and betryl.In June, PPC purchased 10,000 gallons of the material

PP Company purchases a material that is then processed to yield three chemicals: anarol, estyl, and betryl.In June, PPC purchased 10,000 gallons of the material at a cost of $250,000, and the company incurred joint conversion costs of $70,000.June sales andproduction information are as follows:

Amarol and estyl are sold to other pharmaceutical companies at the split-off point.Betryl can be sold at the split -off point or processed further and packaged for sale as an asthma medication.

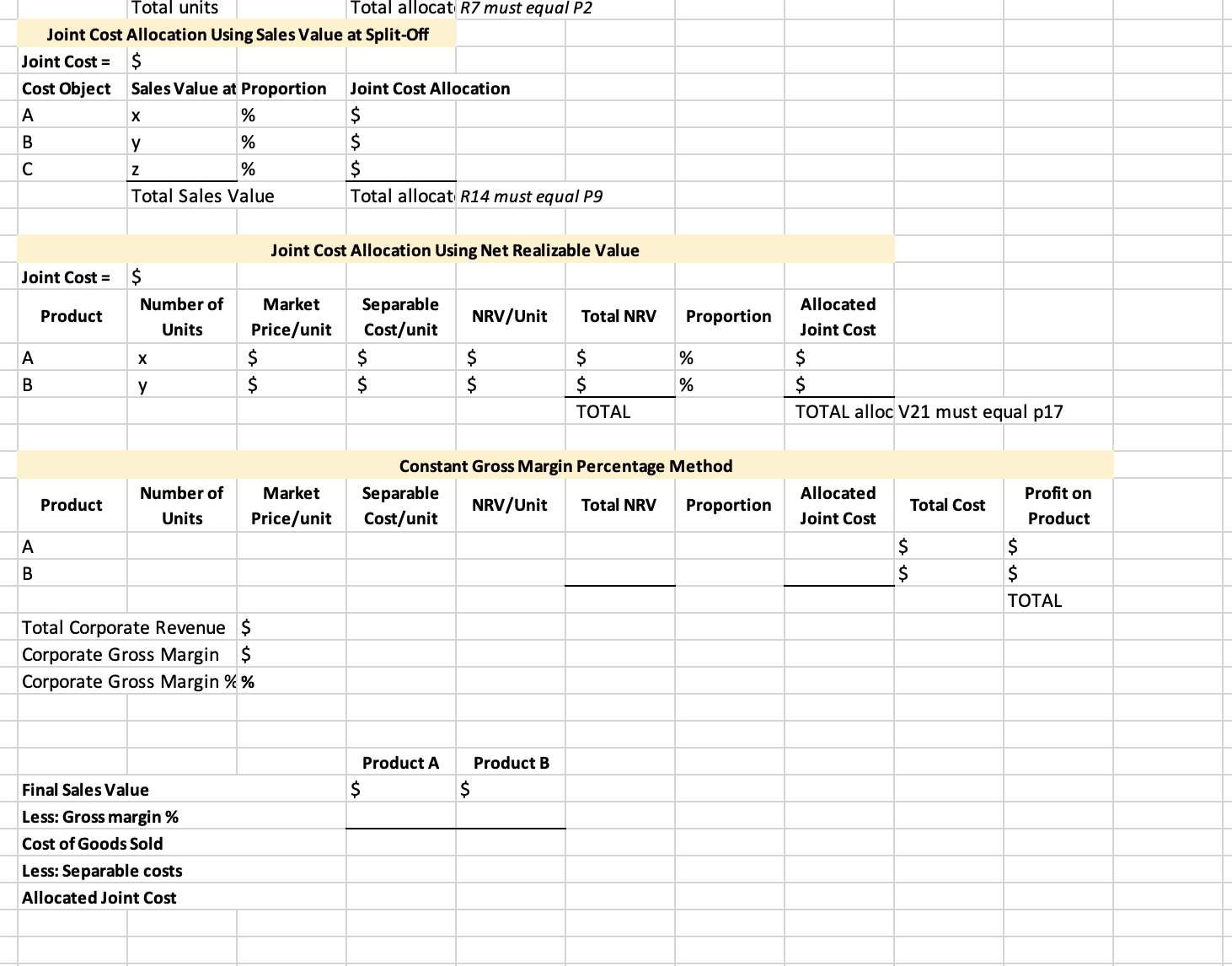

1. Allocate the joint costs to the three products using:

a. The physical units method

b. The sales-value-at-split-off method (Use =ROUND to round allocation ratios to 5 digits)

c. The net realizable value method (Use =ROUND to round allocation ratios to 5 digits, except for Betryl — use =ROUNDUP for that ratio to get your check figures)

d. The constant gross margin percentage method (use =ROUND to 4 decimal places on the GM%. There will be a rounding error of $23 in the final total check figure.)

Answer should be in this form:

Gallons Price at Produced Split-Off Further Processing Cost per Gallon Eventual Sales Price Amarol 2,000 $55 Estyl 3,000 40 Betryl 5,000 30 $5 $60

Step by Step Solution

There are 3 Steps involved in it

Joint Cost Allocation Using Sales Value at SplitOff Joint Cost 70000 Cost Object Sales Value at Prop... View full answer

Get step-by-step solutions from verified subject matter experts