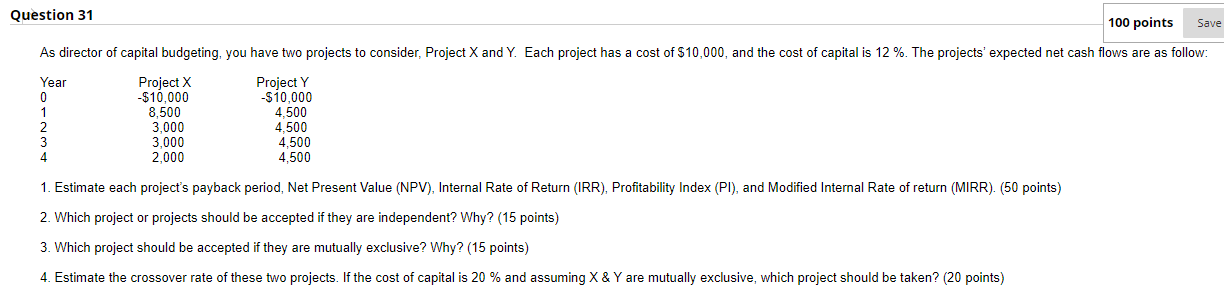

Question: PPLEASE SHOW ALL WORK Question 31 100 points Save cost of $10,000, and the cost of capital is 12 %. The projects' expected net cash

PPLEASE SHOW ALL WORK

PPLEASE SHOW ALL WORK

Question 31 100 points Save cost of $10,000, and the cost of capital is 12 %. The projects' expected net cash flows are as follow: As director of capital budgeting, you have two projects to consider, Project X and Y. Each project has Year Project X Project Y 0 -$10,000 -$10,000 8,500 3,000 4.500 3 3,000 4,500 2.000 4.500 4,500 1. Estimate each project's payback period, Net Present Value (NPV), Internal Rate of Return (IRR), Profitability Index (PI), and Modified Internal Rate of return (MIRR). (50 points) 2. Which project or projects should be accepted if they are independent? Why? (15 points) 3. Which project should be accepted if they are mutually exclusive? Why? (15 points) 4. Estimate the crossover rate of these two projects. If the cost of capital is 20 % and assuming X & Y are mutually exclusive, which project should be taken? (20 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts