Question: pplease step by step show all calculation in good form 65) Rita, a self-employed CPA, incurred the following expenses during the year: Transportation expenses for

pplease step by step show all calculation in good form

pplease step by step show all calculation in good form

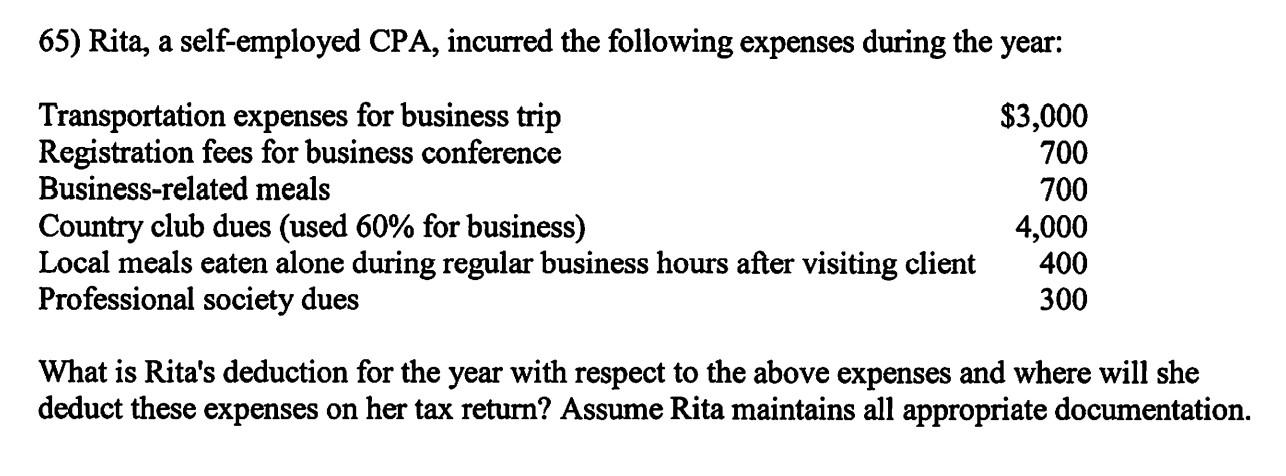

65) Rita, a self-employed CPA, incurred the following expenses during the year: Transportation expenses for business trip Registration fees for business conference Business-related meals Country club dues (used 60% for business) Local meals eaten alone during regular business hours after visiting client Professional society dues $3,000 700 700 4,000 400 300 What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expenses on her tax return? Assume Rita maintains all appropriate documentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts