Question: PPT Sdn Bhd buys Alpha-11 for RM6 a litre. At the end of distilling in Department A, Alpha-11 splits off into three products: Beta

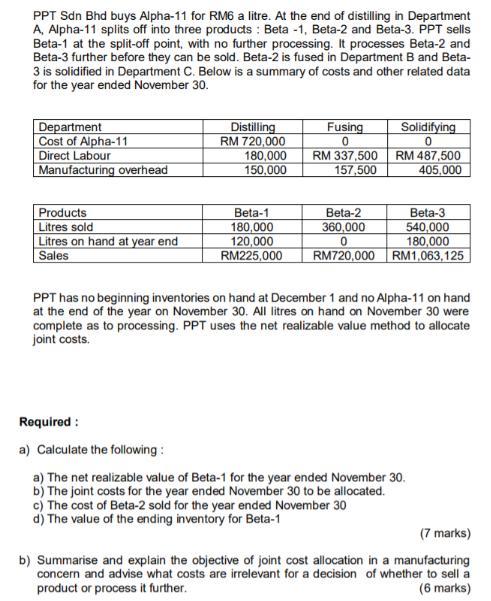

PPT Sdn Bhd buys Alpha-11 for RM6 a litre. At the end of distilling in Department A, Alpha-11 splits off into three products: Beta -1, Beta-2 and Beta-3. PPT sells Beta-1 at the split-off point, with no further processing. It processes Beta-2 and Beta-3 further before they can be sold. Beta-2 is fused in Department B and Beta- 3 is solidified in Department C. Below is a summary of costs and other related data for the year ended November 30. Department Cost of Alpha-11 Direct Labour Manufacturing overhead Distilling Fusing 0 Solidifying RM 720,000 0 180,000 150,000 RM 337,500 RM 487,500 157,500 405,000 Products Beta-1 Beta-2 Beta-3 Litres sold 180,000 360,000 540,000 Litres on hand at year end Sales 120,000 RM225,000 0 180,000 RM720,000 RM1,063,125 PPT has no beginning inventories on hand at December 1 and no Alpha-11 on hand at the end of the year on November 30. All litres on hand on November 30 were complete as to processing. PPT uses the net realizable value method to allocate joint costs. Required: a) Calculate the following: a) The net realizable value of Beta-1 for the year ended November 30. b) The joint costs for the year ended November 30 to be allocated. c) The cost of Beta-2 sold for the year ended November 30 d) The value of the ending inventory for Beta-1 (7 marks) b) Summarise and explain the objective of joint cost allocation in a manufacturing concern and advise what costs are irrelevant for a decision of whether to sell a product or process it further. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts