Question: PR 16-2B oRd the summarized operations. Work in Process Work 127,880 related to production for April, the first month of operations PR 16-2B Entries and

PR 16-2B

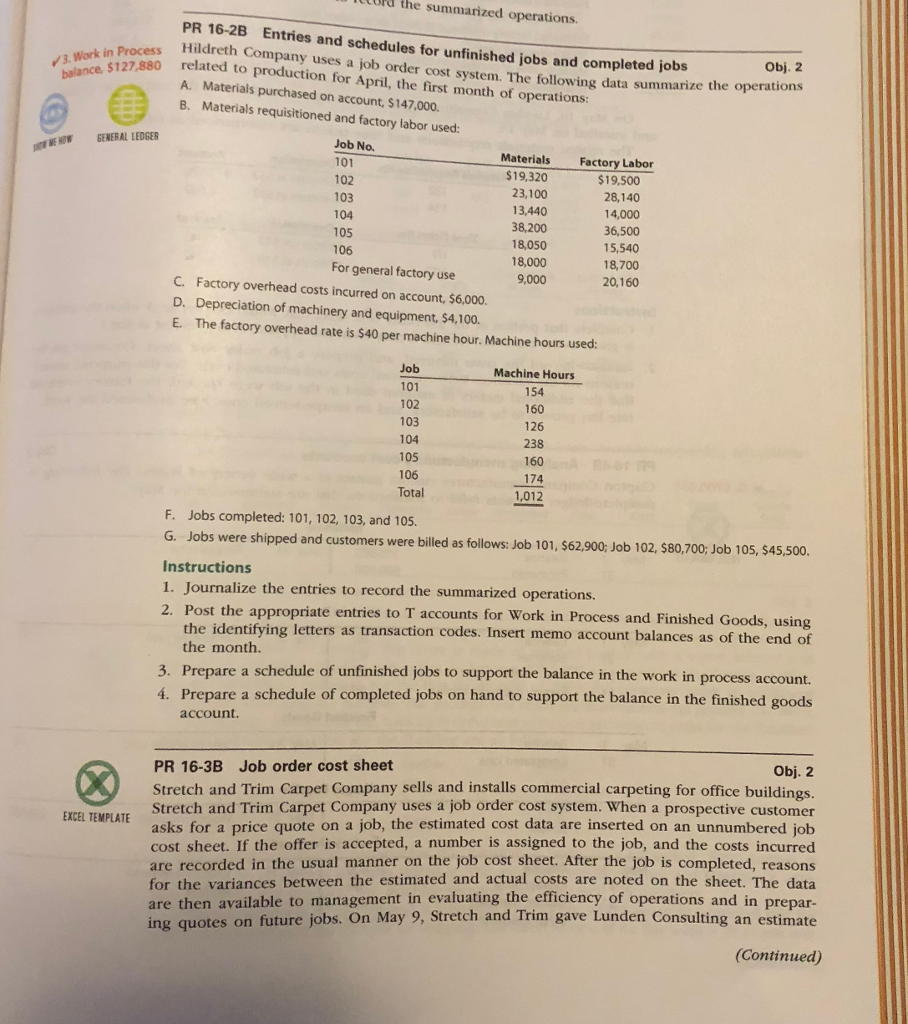

oRd the summarized operations. Work in Process Work 127,880 related to production for April, the first month of operations PR 16-2B Entries and schedules for unfinished jobs and completed jobs Hildreth Company uses a job order cost system. The following data sum Obj. 2 e operations summarize the A. Materials purchased on account, $147,000. B. Materials requisitioned and factory labor used: GENERAL LEDGER Job No. 101 102 Materials Factory Labor $19,320 23,100 13,440 38,200 18,050 18,000 9,000 $19,500 28,140 14,000 36,500 15,540 18,700 20,160 106 For general factory use C. Factory overhead costs incurred on account, $6,000 D. Depreciation of machinery and equipment, $4,100. E. The factory overhead rate is $40 per machine hour. Machine hours used: Machine Hours 154 160 126 238 160 174 1,012 102 103 104 106 F. Jobs completed: 101, 102, 103, and 105. G. Jobs were shipped and customers were billed as follows Instructions 1. Journalize the entries to record the summarized operations. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, usi Job 101, $62,900; Job 102, $80,700; Job 105, $45,500 the identifying letters as transaction codes. Insert memo account balances as of the the month. end of 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account. PR 16-3B Job order cost sheet Obj. 2 Stretch and Trim Carpet Company sells and installs commercial carpeting for office buildings. Stretch and Trim Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in prepar- ing quotes on future jobs. On May 9, Stretch and Trim gave Lunden Consulting an estimate (Continued) EXCEL TEMPLATE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts