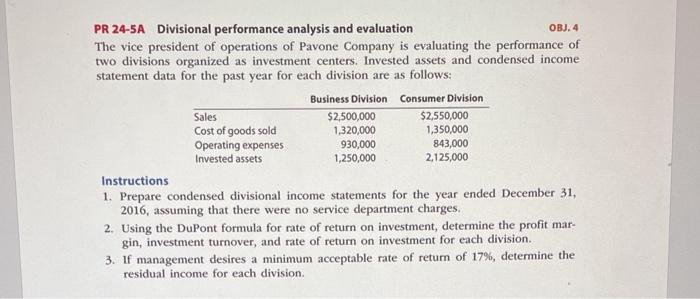

Question: PR 24-5A Divisional performance analysis and evaluation OBJ.4 The vice president of operations of Pavone Company is evaluating the performance of two divisions organized as

PR 24-5A Divisional performance analysis and evaluation OBJ.4 The vice president of operations of Pavone Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Business Division Consumer Division Sales $2,500,000 $2,550,000 Cost of goods sold 1,320,000 1,350,000 Operating expenses 930,000 843,000 Invested assets 1,250,000 2,125,000 Instructions 1. Prepare condensed divisional income statements for the year ended December 31, 2016, assuming that there were no service department charges. 2. Using the DuPont formula for rate of return on investment, determine the profit mar- gin, investment turnover, and rate of return on investment for each division. 3. If management desires a minimum acceptable rate of return of 17%, determine the residual income for each division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts