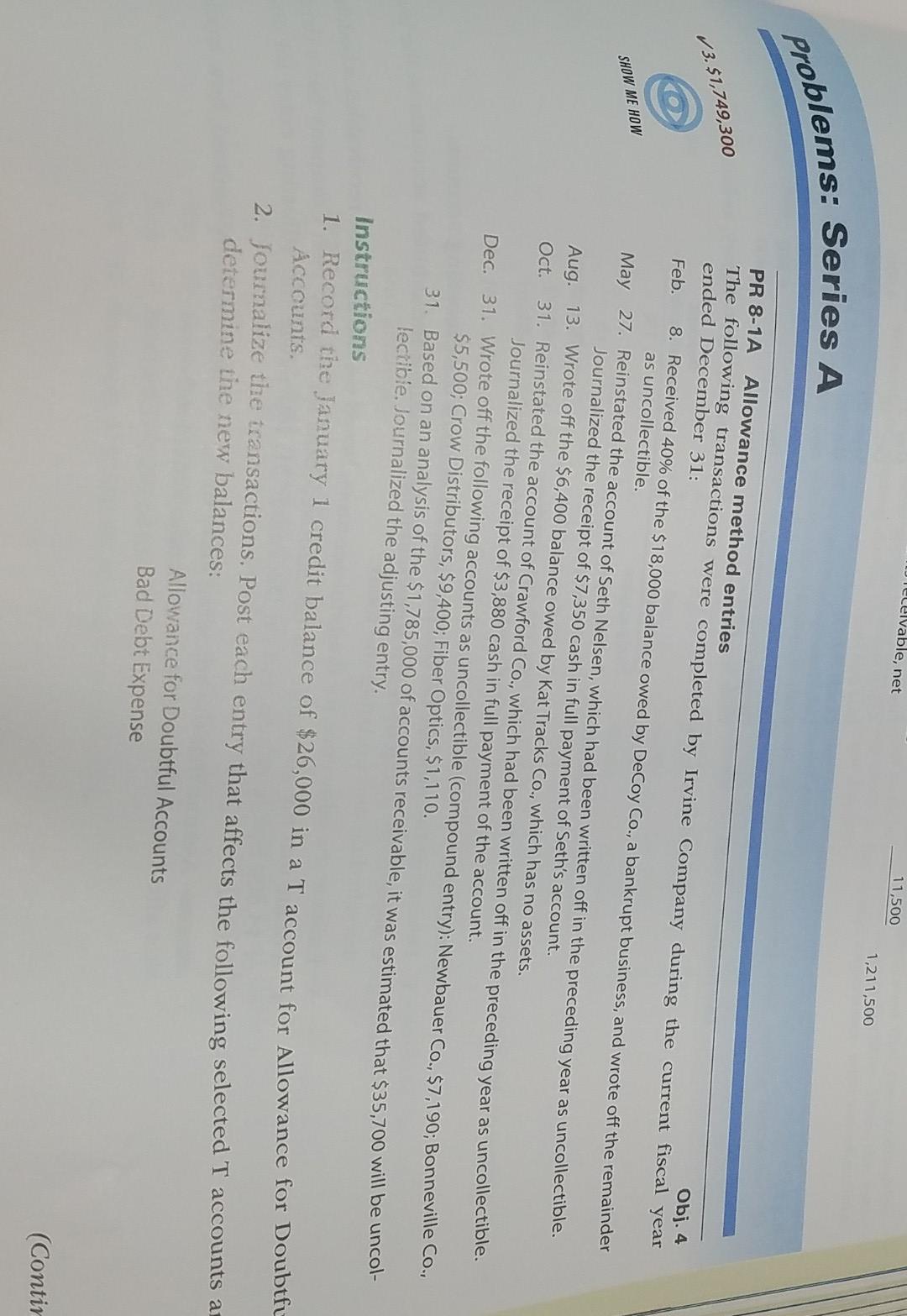

Question: PR 8 - 1A Allowance method entries. pagw 431 chapter 8 PR 8-1A Allowance method entries The following transactions were completed by Irvine Company during

PR 8 - 1A Allowance method entries. pagw 431 chapter 8

PR 8-1A Allowance method entries The following transactions were completed by Irvine Company during the curc ended December 31: as uncollectible. Journalized the receipt of $7,350 cash in wich had been written off in the preceding year as uncollectible. Aug. 13. Wrote off the $6,400 balance owed by in payment of Seth's account. Oct. 31. Reinstated the account of Crawford Co Kat Tracks Co., which has no assets. Journalized the receipt of $3,880 cash in full haym been written off in the preceding year as uncollectible. Dec. 31. Wrote off the following accounts as uncollectible (he account. $5,500; Crow Distributors, \$9,400; Fiber Optics, \$1,110. 31. Based on an analysis of the $1,785,000 of accounts receivable, it was estimated that $35,700 will be uncollecribie. Journalized the adjusting entry. Instructions 1. Recotd the January l credit balance of $26,000 in a T account for Allowance for Doubt Accounts. 2. foumalize the transactions, Post each entry that affects the following selected T accounts determine the new balances: Allowance for Doubtful Accounts Bad Debt Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts