Question: Practical Problems on EBIT-EPS Analysis 1. Suppose a firm has a capital structure exclusively comprising of ordinary shares amounting to Rs. 10,00,000. The firm now

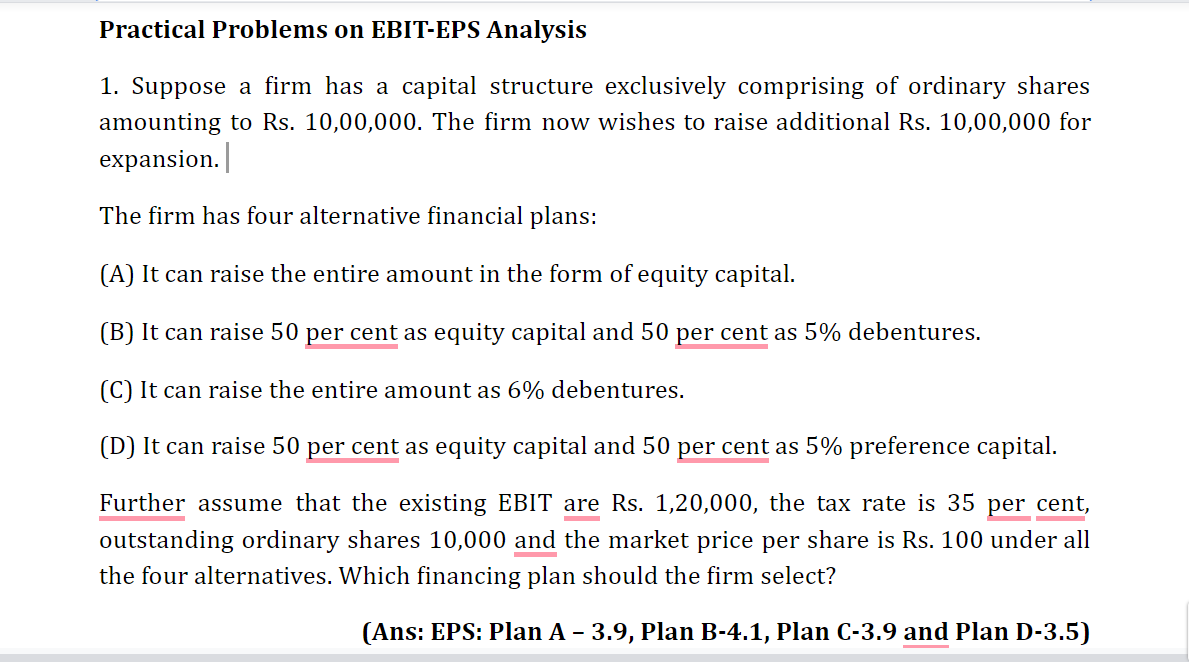

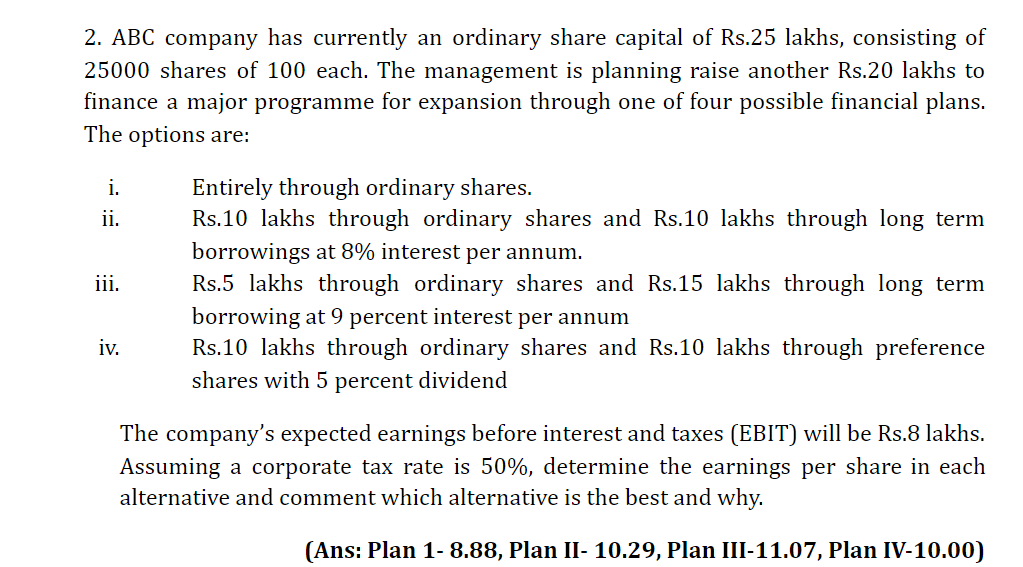

Practical Problems on EBIT-EPS Analysis 1. Suppose a firm has a capital structure exclusively comprising of ordinary shares amounting to Rs. 10,00,000. The firm now wishes to raise additional Rs. 10,00,000 for expansion. The firm has four alternative financial plans: (A) It can raise the entire amount in the form of equity capital. (B) It can raise 50 per cent as equity capital and 50 per cent as 5% debentures. (C) It can raise the entire amount as 6% debentures. (D) It can raise 50 per cent as equity capital and 50 per cent as 5% preference capital. Further assume that the existing EBIT are Rs. 1,20,000, the tax rate is 35 per cent, outstanding ordinary shares 10,000 and the market price per share is Rs. 100 under all the four alternatives. Which financing plan should the firm select? (Ans: EPS: Plan A-3.9, Plan B-4.1, Plan C-3.9 and Plan D-3.5) 2. ABC company has currently an ordinary share capital of Rs.25 lakhs, consisting of 25000 shares of 100 each. The management is planning raise another Rs.20 lakhs to finance a major programme for expansion through one of four possible financial plans. The options are: i. . lii Entirely through ordinary shares. Rs.10 lakhs through ordinary shares and Rs.10 lakhs through long term borrowings at 8% interest per annum. Rs.5 lakhs through ordinary shares and Rs.15 lakhs through long term borrowing at 9 percent interest per annum Rs.10 lakhs through ordinary shares and Rs.10 lakhs through preference shares with 5 percent dividend iv. The company's expected earnings before interest and taxes (EBIT) will be Rs.8 lakhs. Assuming a corporate tax rate is 50%, determine the earnings per share in each alternative and comment which alternative is the best and why. (Ans: Plan 1-8.88, Plan II- 10.29, Plan III-11.07, Plan IV-10.00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts