Question: Practical Question 3 - Accounting for PPE - 15 Marks On 30 June 2020, the Statement of Financial Position of Rocket Ltd showed the

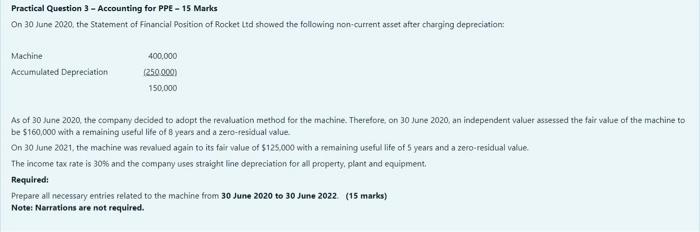

Practical Question 3 - Accounting for PPE - 15 Marks On 30 June 2020, the Statement of Financial Position of Rocket Ltd showed the following non-current asset after charging depreciation: Machine Accumulated Depreciation 400,000 (250.000) 150,000 As of 30 June 2020, the company decided to adopt the revaluation method for the machine. Therefore, on 30 June 2020, an independent valuer assessed the fair value of the machine to be $160,000 with a remaining useful life of 8 years and a zero-residual value. On 30 June 2021, the machine was revalued again to its fair value of $125,000 with a remaining useful life of 5 years and a zero-residual value. The income tax rate is 30% and the company uses straight line depreciation for all property, plant and equipment. Required: Prepare all necessary entries related to the machine from 30 June 2020 to 30 June 2022. (15 marks) Note: Narrations are not required.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts