Question: PRACTICAL QUESTIONS (PQ9) (Please submit this to submission 4 folder) Smith Stationary Ltd needs to raise $500,000 to improve its manufacturing plant. It has decided

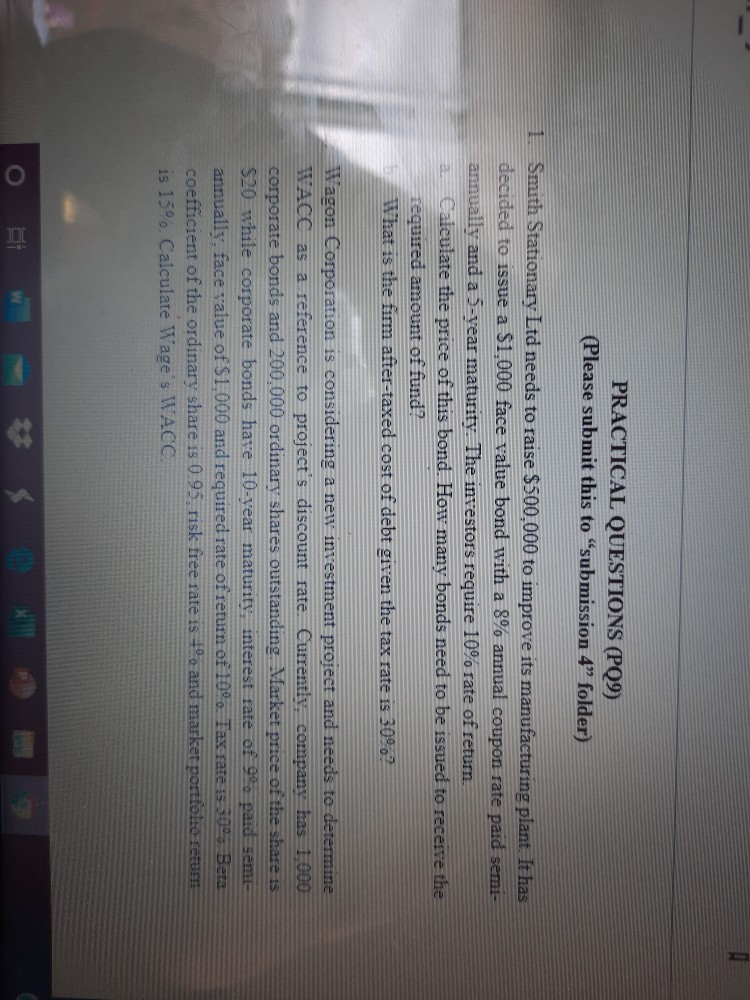

PRACTICAL QUESTIONS (PQ9) (Please submit this to "submission 4" folder) Smith Stationary Ltd needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 face value bond with a 8% annual coupon rate paid semi- annually and a 5-year maturity. The investors require 10% rate of return Calculate the price of this bond. How many bonds need to be issued to receive the required amount of fund? What is the firm after-taxed cost of debt given the tax rate is 30%? Wagon Corporation is considering a new investment project and needs to determine HACC as a reference to project's discount rate. Currently, company has 1,000 corporate bonds and 200,000 ordinary shares outstanding. Market price of the share is! $20 while corporate bonds have 10-year maturity, interest rate of 90 paid sem annually, face value of $1,000 and required rate of return of 10%. Tax rate is 300. Beta coefficient of the ordinary share is 0.95. risk free rate is 10 and market portfoto ratu is 15%. Calculate Wage's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts