Question: Practical Task 2: You currently work for Harlow Accounting. You are required to send out a business letter to a client in regards to their

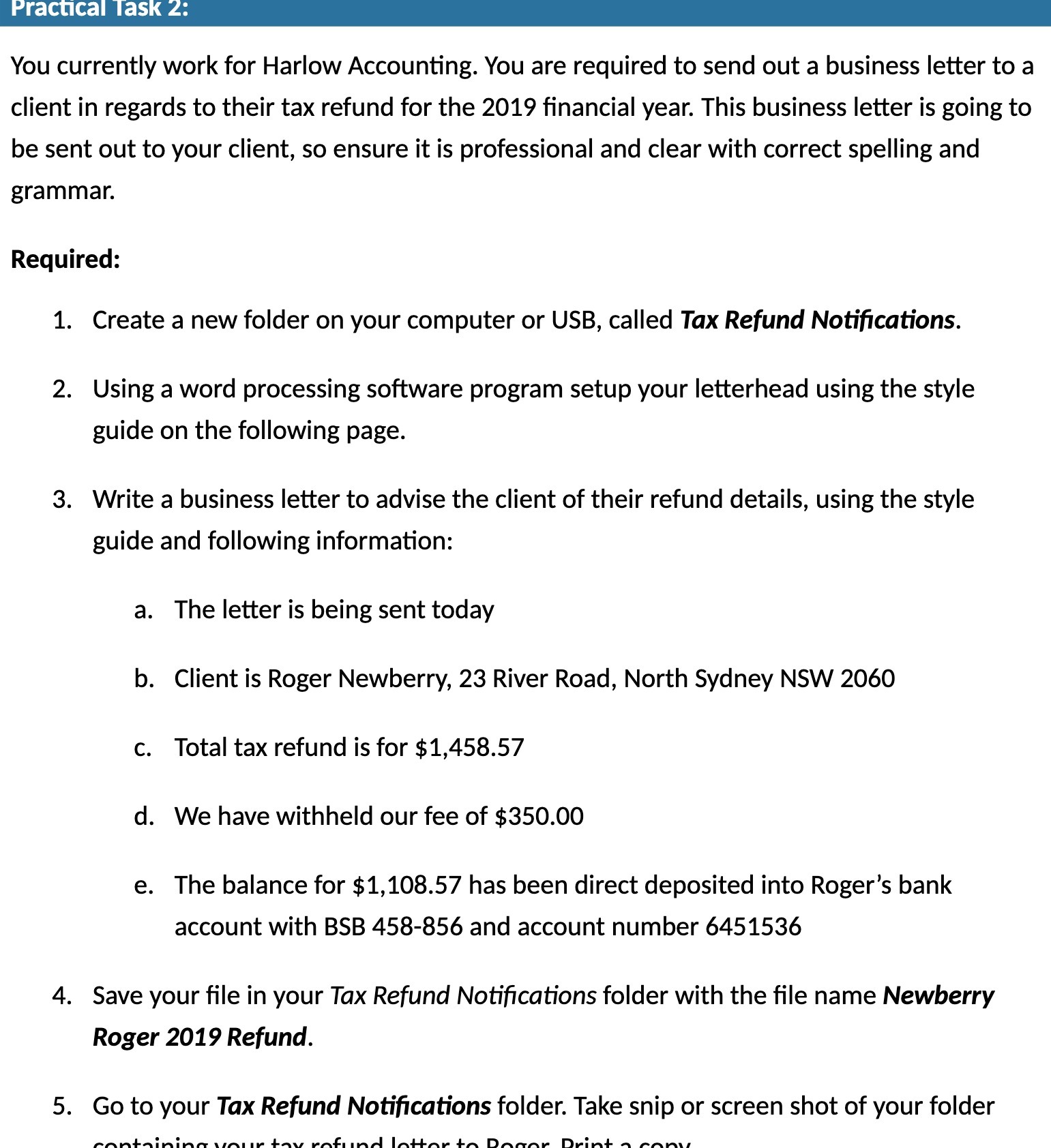

Practical Task 2: You currently work for Harlow Accounting. You are required to send out a business letter to a client in regards to their tax refund for the 2019 financial year. This business letter is going to be sent out to your client, so ensure it is professional and clear with correct spelling and grammar. Required: 1. Create a new folder on your computer or USB, called Tax Refund Notifications. 2. Using a word processing software program setup your letterhead using the style guide on the following page. 3. Write a business letter to advise the client of their refund details, using the style guide and following information: a. The letter is being sent today b. Client is Roger Newberry, 23 River Road, North Sydney NSW 2060 c. Total tax refund is for $1,458.57 d. We have withheld our fee of $350.00 e. The balance for $1,108.57 has been direct deposited into Roger's bank account with BSB 458-856 and account number 6451536 4. Save your file in your Tax Refund Notifications folder with the file name Newberry Roger 2019 Refund. 5. Go to your Tax Refund Notifications folder. Take snip or screen shot of your folder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts