Question: PRACTICE 1 (3 POINTS) The company your work for is considering expanding into other industries. However, it is concerned that those industries that are dominated

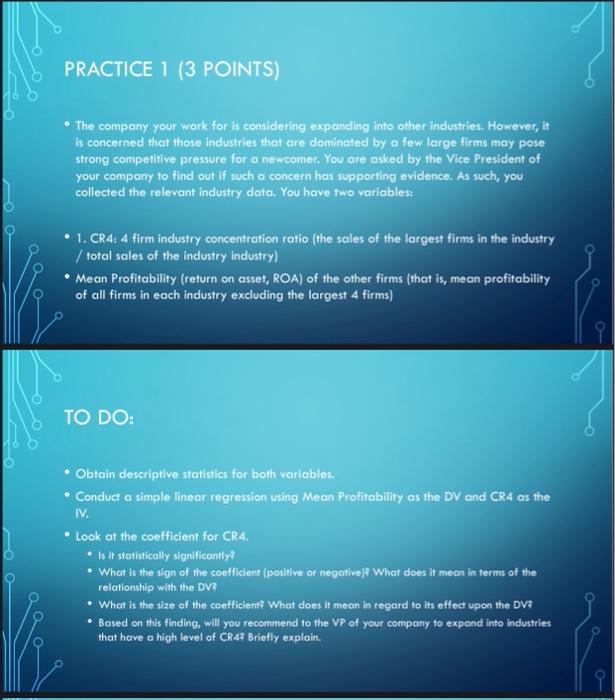

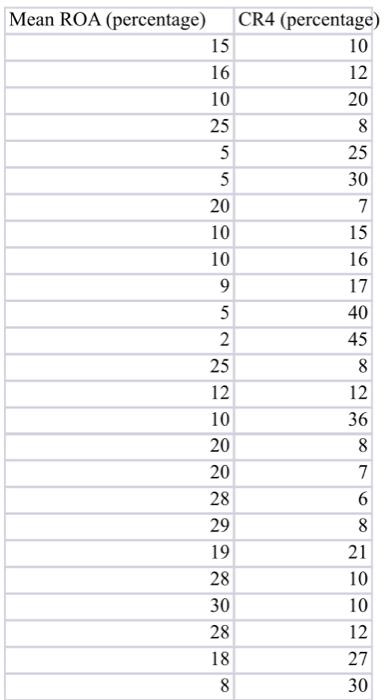

PRACTICE 1 (3 POINTS) The company your work for is considering expanding into other industries. However, it is concerned that those industries that are dominated by a few large firms may pose strong competitive pressure for a newcomer. You are asked by the Vice President of your company to find out if such a concern has supporting evidence. As such, you collected the relevant industry data. You have two variables: . 1. CR4: 4 firm industry concentration ratio (the sales of the largest firms in the industry / total sales of the industry industry) Mean Profitability (return on asset, ROA) of the other firms (that is, mean profitability of all firms in each industry excluding the largest 4 firms) 9 TO DO: Obtain descriptive statistics for both variables. Conduct a simple linear regression using Mean Profitability as the DV and CR4 as the IV. Look at the coefficient for CR4. Is it statistically significantly What is the sign of the coefficient (positive or negativeWhat does it mean in terms of the relationship with the DV? What is the size of the coefficient? What does it mean in regard to its effect upon the DV . Based on this finding, will you recommend to the VP of your company to expand into industries that have a high level of CR4? Briefly explain. 9 Mean ROA (percentage) CR4 (percentage) 15 10 16 12 10 20 25 8 5 25 5 30 20 7 10 15 10 16 9 17 5 40 2 45 25 8 12 12 10 36 20 8 20 7 28 6 29 8 21 28 10 30 10 28 12 Nu 3 19 18 27 8 30 PRACTICE 1 (3 POINTS) The company your work for is considering expanding into other industries. However, it is concerned that those industries that are dominated by a few large firms may pose strong competitive pressure for a newcomer. You are asked by the Vice President of your company to find out if such a concern has supporting evidence. As such, you collected the relevant industry data. You have two variables: . 1. CR4: 4 firm industry concentration ratio (the sales of the largest firms in the industry / total sales of the industry industry) Mean Profitability (return on asset, ROA) of the other firms (that is, mean profitability of all firms in each industry excluding the largest 4 firms) 9 TO DO: Obtain descriptive statistics for both variables. Conduct a simple linear regression using Mean Profitability as the DV and CR4 as the IV. Look at the coefficient for CR4. Is it statistically significantly What is the sign of the coefficient (positive or negativeWhat does it mean in terms of the relationship with the DV? What is the size of the coefficient? What does it mean in regard to its effect upon the DV . Based on this finding, will you recommend to the VP of your company to expand into industries that have a high level of CR4? Briefly explain. 9 Mean ROA (percentage) CR4 (percentage) 15 10 16 12 10 20 25 8 5 25 5 30 20 7 10 15 10 16 9 17 5 40 2 45 25 8 12 12 10 36 20 8 20 7 28 6 29 8 21 28 10 30 10 28 12 Nu 3 19 18 27 8 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts