Question: Practice #3 - with unit costs: Jeff Jamail is evaluating a business opportunity to sell cookware at trade shows. Mr. Jamail can buy the cookware

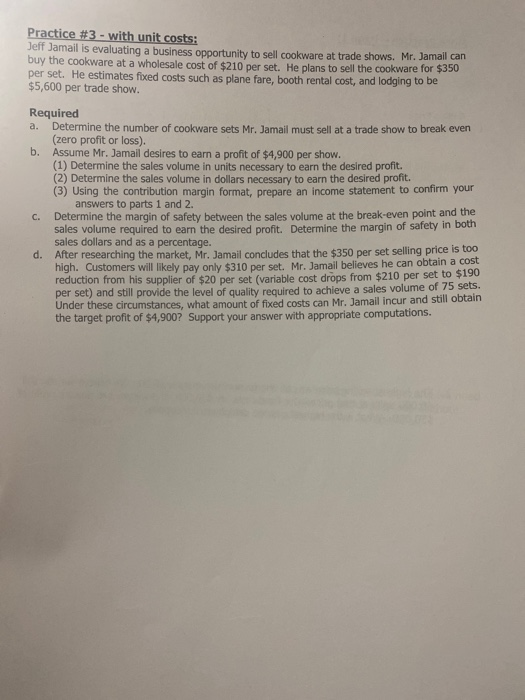

Practice #3 - with unit costs: Jeff Jamail is evaluating a business opportunity to sell cookware at trade shows. Mr. Jamail can buy the cookware at a wholesale cost of $210 per set. He plans to sell the cookware for $350 per set. He estimates fixed costs such as plane fare, booth rental cost, and lodging to be $5,600 per trade show. a. Required Determine the number of cookware sets Mr. Jamail must sell at a trade show to break even (zero profit or loss). b. Assume Mr. Jamail desires to earn a profit of $4,900 per show. (1) Determine the sales volume in units necessary to earn the desired profit. (2) Determine the sales volume in dollars necessary to earn the desired profit. (3) Using the contribution margin format, prepare an income statement to confirm your answers to parts 1 and 2. Determine the margin of safety between the sales volume at the break-even point and the sales volume required to earn the desired profit. Determine the margin of safety in both sales dollars and as a percentage. d. After researching the market, Mr. Jamail concludes that the $350 per set selling price is too high. Customers will likely pay only $310 per set. Mr. Jamail believes he can obtain a cost reduction from his supplier of $20 per set (variable cost drops from $210 per set to $190 per set) and still provide the level of quality required to achieve a sales volume of 75 sets. Under these circumstances, what amount of fixed costs can Mr. Jamail incur and still obtain the target profit of $4,900? Support your answer with appropriate computations. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts