Question: Practice Assignment #7 1. Mr. Bond is considering purchasing a bond with 7-year maturity and $1,000 face value. The coupon interest rate is 9% and

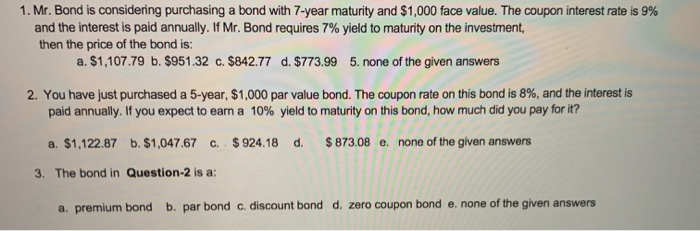

1. Mr. Bond is considering purchasing a bond with 7-year maturity and $1,000 face value. The coupon interest rate is 9% and the interest is paid annually. If Mr. Bond requires 7% yield to maturity on the investment, then the price of the bond is: a. $1,107.79 b. $951.32 c. $842.77 d. $773.99 5. none of the given answers 2. You have just purchased a 5-year, $1,000 par value bond. The coupon rate on this bond is 8%, and the interest is paid annually. If you expect to earn a 10% yield to maturity on this bond, how much did you pay for it? a. $1,122.87 b. $1,047.67 C $924.18 d. $873.08 o. none of the given answers 3. The bond in Question-2 is a: a. premium bond b. par bond c. discount bond d. zero coupon bond e. none of the given answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts