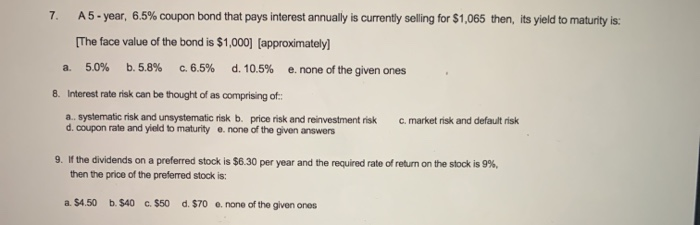

Question: Practice Assignment #7 7. A5-year, 6.5% coupon bond that pays interest annually is currently selling for $1,065 then, its yield to maturity is: [The face

7. A5-year, 6.5% coupon bond that pays interest annually is currently selling for $1,065 then, its yield to maturity is: [The face value of the bond is $1,000) (approximately] 5.0% b.5.8% c. 6.5% d. 10.5% e. none of the given ones a 8. Interest rate risk can be thought of as comprising of: 3.. systematic risk and unsystematic risk b. price risk and reinvestment risk d. coupon rate and yield to maturity e. none of the given answers c. market risk and default risk 9. If the dividends on a preferred stock is $6.30 per year and the required rate of return on the stock is 9% then the price of the preferred stock is: a. $4.50 b. $40 c. $50 d. $70 e. none of the given ones

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts