Question: Practice Assignment #8 Question 10 (1 point) NPVs of projects A, B and C are as follows: NPV(A) = -90; NPV(B) = + 120; &

Practice Assignment #8

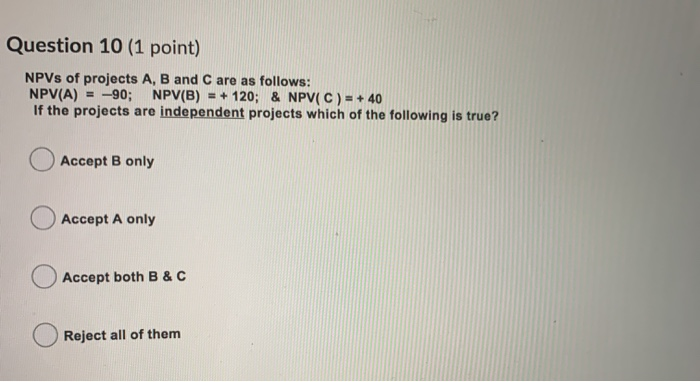

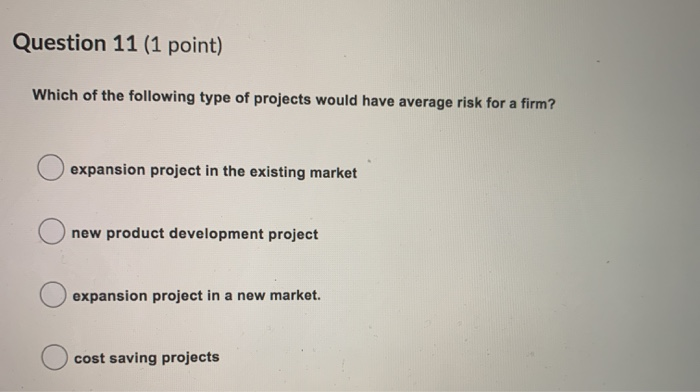

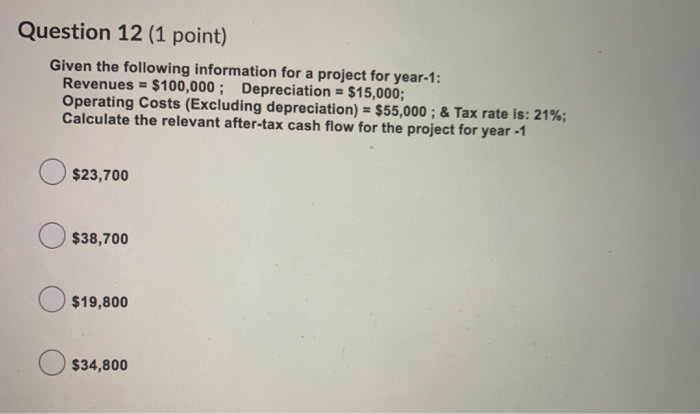

Question 10 (1 point) NPVs of projects A, B and C are as follows: NPV(A) = -90; NPV(B) = + 120; & NPV(C) = + 40 If the projects are independent projects which of the following is true? Accept B only Accept A only Accept both B&C Reject all of them Question 11 (1 point) Which of the following type of projects would have average risk for a firm? expansion project in the existing market new product development project expansion project in a new market. cost saving projects Question 12 (1 point) Given the following information for a project for year-1: Revenues = $100,000; Depreciation = $15,000; Operating Costs (Excluding depreciation) = $55,000 ; & Tax rate is: 21%; Calculate the relevant after-tax cash flow for the project for year-1 $23,700 $38,700 $19,800 $34,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts