Question: practice exam questions , help would be really appreicated and returned with a thumbs up!! thanks in advance U not open until ready) 6 4

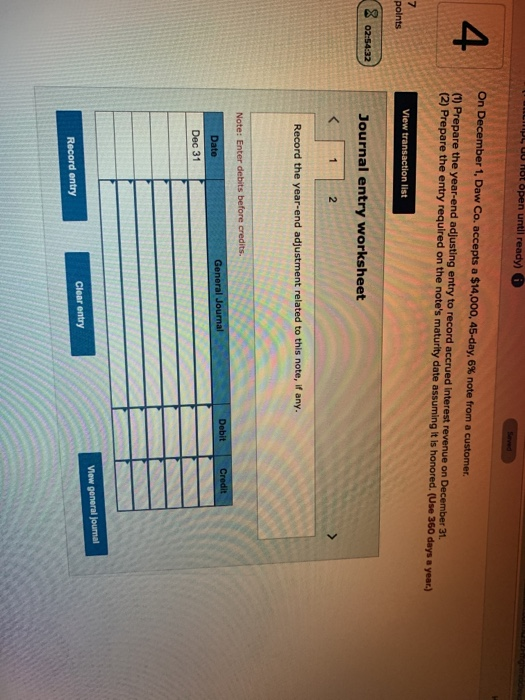

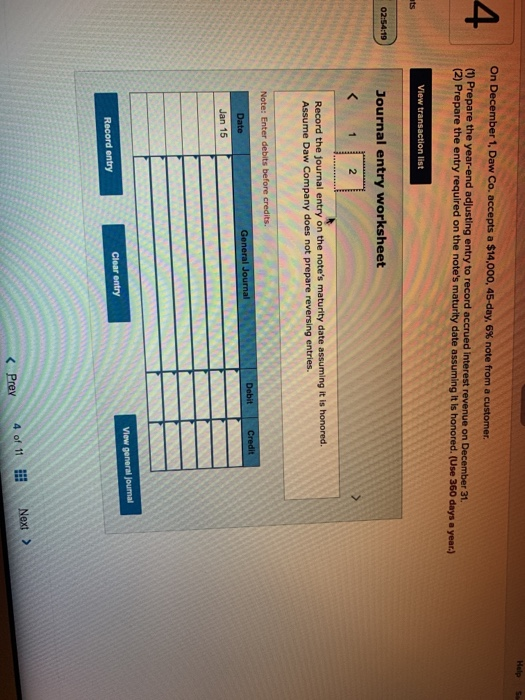

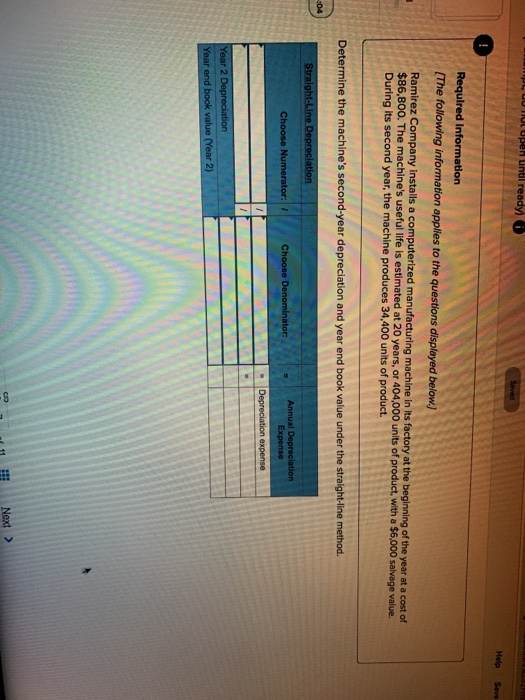

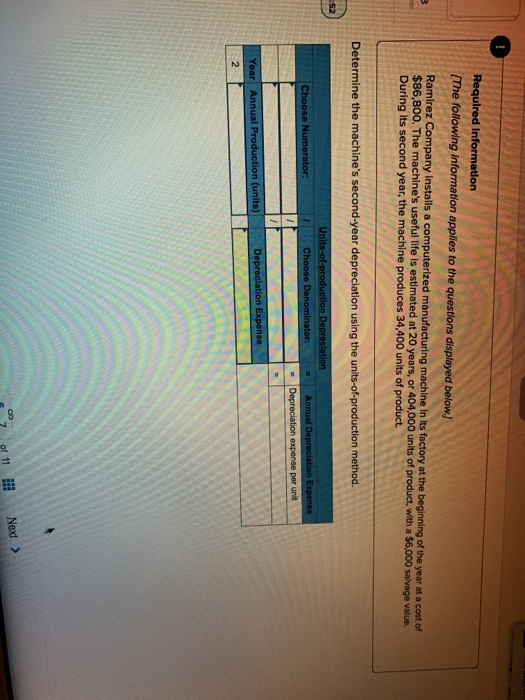

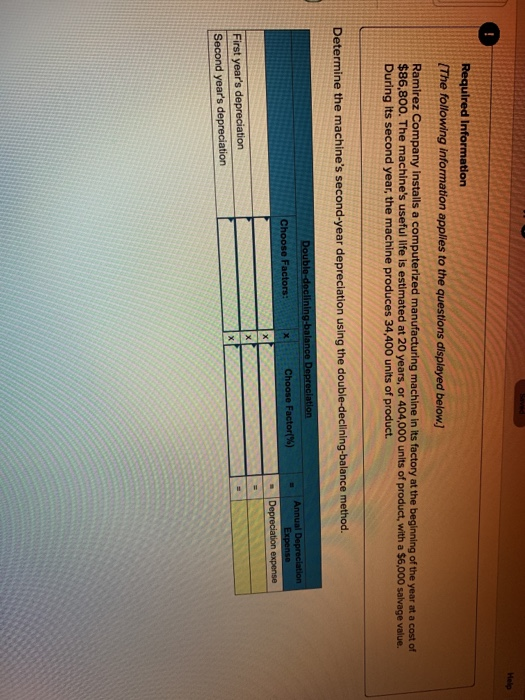

U not open until ready) 6 4 On December 1, Daw Co. accepts a $14,000, 45-day, 6% note from a customer. (1) Prepare the year-end adjusting entry to record accrued Interest revenue on December 31. (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.) 7 points View transaction list 8 02:54:32 Journal entry worksheet 1 2 Record the year-end adjustment related to this note, if any. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 View general Journal Clear entry Record entry Help On December 1, Daw Co. accepts a $14,000, 45-day, 6% note from a customer. 4 (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31 (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.) View transaction list ats 02:54:19 Journal entry worksheet 2 Record the journal entry on the note's maturity date assuming it is honored. Assume Daw Company does not prepare reversing entries. Note: Enter debits before credits. Debit Credit General Journal Date Jan 15 View general Journal Clear entry Record entry Next > Required Information [The following information applies to the questions displayed below.) Ramirez Company Installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Determine the machine's second-year depreciation using the units-of-production method. 52 Units-of-production Depreciation Choose Denominator: Choose Numerator: Annual Depreciation Expense Depreciation expense per unit Depreciation Expense Year Annual Production (units) 2 of 11 Next > Help Required Information (The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Determine the machine's second-year depreciation using the double-declining-balance method. Double-declining balance Depreciation Choose Factors: Choose Factor(%) Annual Depreciation Expense Depreciation expense First year's depreciation Second year's depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts