Question: Practice Exercise 01 On June 1, Larkspur, Inc. borrows $102,000 from First Bank on a 6-month, $102,000, 8% note. (a) Prepare the entry on June

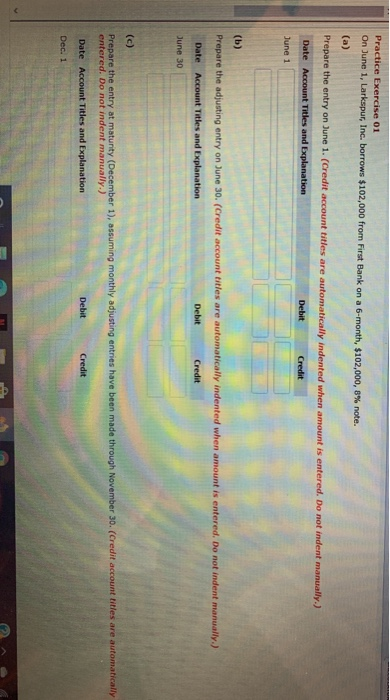

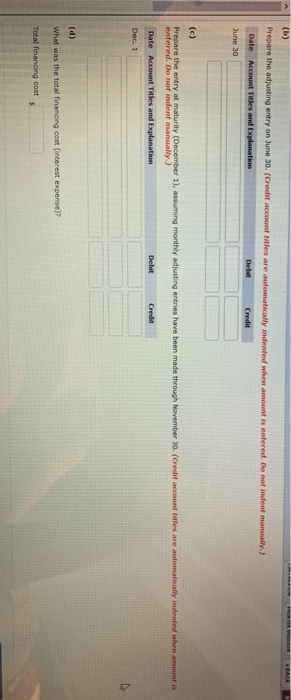

Practice Exercise 01 On June 1, Larkspur, Inc. borrows $102,000 from First Bank on a 6-month, $102,000, 8% note. (a) Prepare the entry on June 1. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Credit Debit June 1 (b) Prepare the adjusting entry on June 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 30 (c) Prepare the entry at maturity (December 1), assuming monthly adjusting entries have been made through November 30. (Credit account titles are automatically entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 1 (b) BACK Prepare the adjusting entry on June 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debat Credit June 30 (c) Prepare the entry at maturity (December 1), assuming monthly adjusting entries have been made through November 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 1 (d) What was the total financing cost interest expense)? Total financing cost $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts