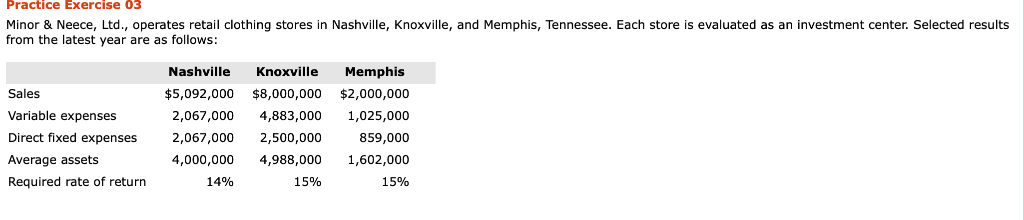

Question: Practice Exercise 03 Minor & Neece, Ltd., operates retail clothing stores in Nashville, Knoxville, and Memphis, Tennessee. Each store is evaluated as an investment center.

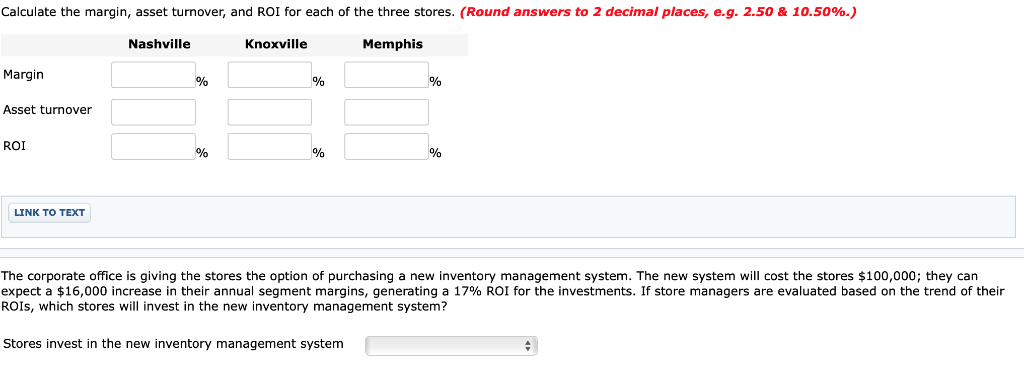

Practice Exercise 03 Minor & Neece, Ltd., operates retail clothing stores in Nashville, Knoxville, and Memphis, Tennessee. Each store is evaluated as an investment center. Selected results from the latest year are as follows: Nashville Knoxville Memphis Sales $5,092,000 $8,000,000 $2,000,000 2,067,000 4,883,000 1,025,000 Direct fixed expenses 2,067,000 2,500,000 859,000 4,000,0004,988,000 1,602,000 1596 Variable expenses Average assets Required rate of return 14% 15% Calculate the margin, asset turnover, and ROI for each of the three stores. (Round answers to 2 decimal places, e.g. 2.50 & 10.50%) Nashville Knoxville Memphis Margin Asset turnover ROI LINK TO TEXT The corporate office is giving the stores the option of purchasing a new inventory management system. The new system will cost the stores $100,000; they can expect a $16,000 increase in their annual segment margins, generating a 17% ROI for the investments. If store managers are evaluated based on the trend of their ROIs, which stores will invest in the new inventory management system? Stores invest in the new inventory management system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts