Question: Brennen sold a machine used in his business for $210,600. The machine was purchased eight years ago for $379,080. Depreciation up to the date

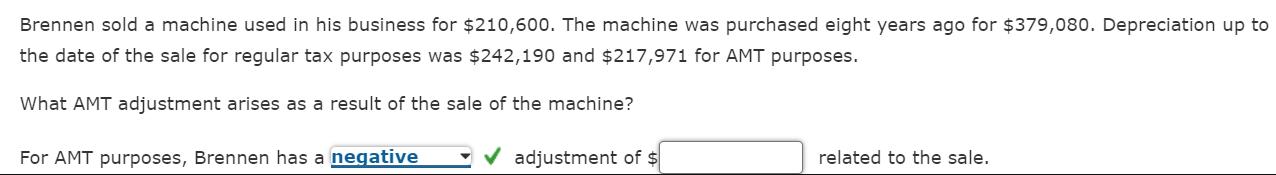

Brennen sold a machine used in his business for $210,600. The machine was purchased eight years ago for $379,080. Depreciation up to the date of the sale for regular tax purposes was $242,190 and $217,971 for AMT purposes. What AMT adjustment arises as a result of the sale of the machine? For AMT purposes, Brennen has a negative adjustment of $ related to the sale.

Step by Step Solution

3.55 Rating (172 Votes )

There are 3 Steps involved in it

To determine the AMT adjustment follow these steps 1 Calculate Adjusted Basi... View full answer

Get step-by-step solutions from verified subject matter experts