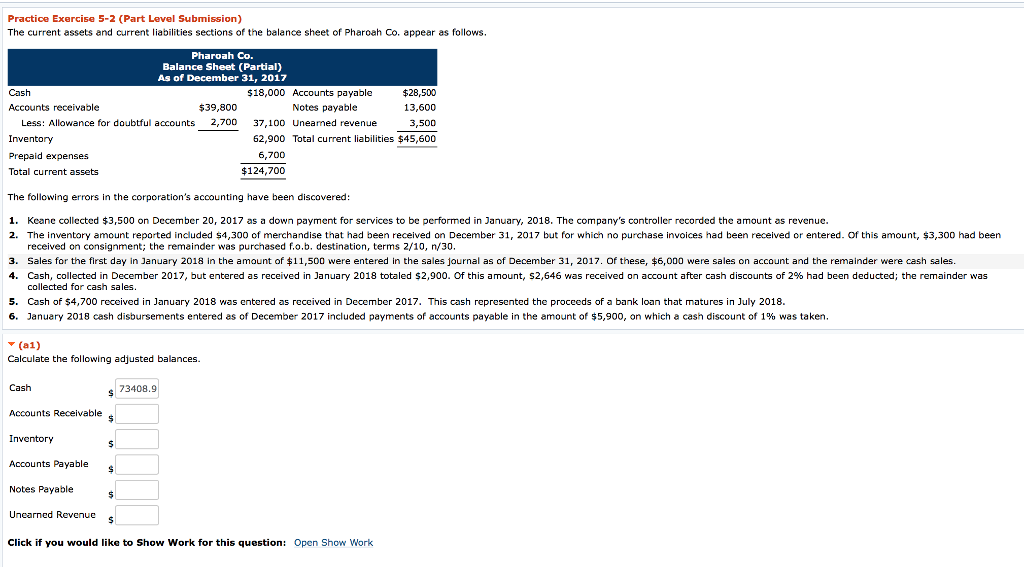

Question: Practice Exercise 5-2 (Part Level Submission) The current assets nd current liabilities sections of the balance sheet of Pharoah Co. appear as follows. Pharoah Co.

Practice Exercise 5-2 (Part Level Submission) The current assets nd current liabilities sections of the balance sheet of Pharoah Co. appear as follows. Pharoah Co. Balance Sheet (Partial) As of December 31, 2017 $28,500 13,600 3,500 62,900 Total current liabilities $45,600 Cash $18,000 Accounts payable $39,800 2,700 37,100 Uneamed revenue Accounts receivable Notes payable Less: Allowance for doubtful accounts Inventony Prepaid expenses Total current assets 6,700 $124,700 The following errors in the corporation's accounting have been discovered 1. Keane collected $3,500 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company's controller recorded the amount as revenue 2. The inventory amount reported included $4,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $3,300 had beern received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. Sales for the first day in January 2018 in the amount of $11,500 were entered in the sales journal as of December 31, 2017 . Of these,6,000 were sales on account and the remainder were cash sales. Cash, collected in December 2017, but entered as received in January 2018 totaled $2,900. Of this a ount, S2.646 was received on account after cash discounts of 2% had been deducted; the remainder was 3. 4. 5. 6. collected for cash sales Cash of $4,700 received in January 2018 was entered as received in December 2017. This cash represented the proceeds of a bank loan that matures in July 2018. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the mount of $5,900, on which cash discount of 1% was taken. (a1) Calculate the following adjusted balances. Cash 73408.9 Accounts Receivable Accounts Payable Notes Payable Uncarned Revenue Click if you would like to Show Work for this question: Open Show Work Practice Exercise 5-2 (Part Level Submission) The current assets nd current liabilities sections of the balance sheet of Pharoah Co. appear as follows. Pharoah Co. Balance Sheet (Partial) As of December 31, 2017 $28,500 13,600 3,500 62,900 Total current liabilities $45,600 Cash $18,000 Accounts payable $39,800 2,700 37,100 Uneamed revenue Accounts receivable Notes payable Less: Allowance for doubtful accounts Inventony Prepaid expenses Total current assets 6,700 $124,700 The following errors in the corporation's accounting have been discovered 1. Keane collected $3,500 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company's controller recorded the amount as revenue 2. The inventory amount reported included $4,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $3,300 had beern received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. Sales for the first day in January 2018 in the amount of $11,500 were entered in the sales journal as of December 31, 2017 . Of these,6,000 were sales on account and the remainder were cash sales. Cash, collected in December 2017, but entered as received in January 2018 totaled $2,900. Of this a ount, S2.646 was received on account after cash discounts of 2% had been deducted; the remainder was 3. 4. 5. 6. collected for cash sales Cash of $4,700 received in January 2018 was entered as received in December 2017. This cash represented the proceeds of a bank loan that matures in July 2018. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the mount of $5,900, on which cash discount of 1% was taken. (a1) Calculate the following adjusted balances. Cash 73408.9 Accounts Receivable Accounts Payable Notes Payable Uncarned Revenue Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts