Question: Practice Exercises Exercise 3 - 1 Alternate Response: On the space provided, write True, if the statement is true or False, if the statement is

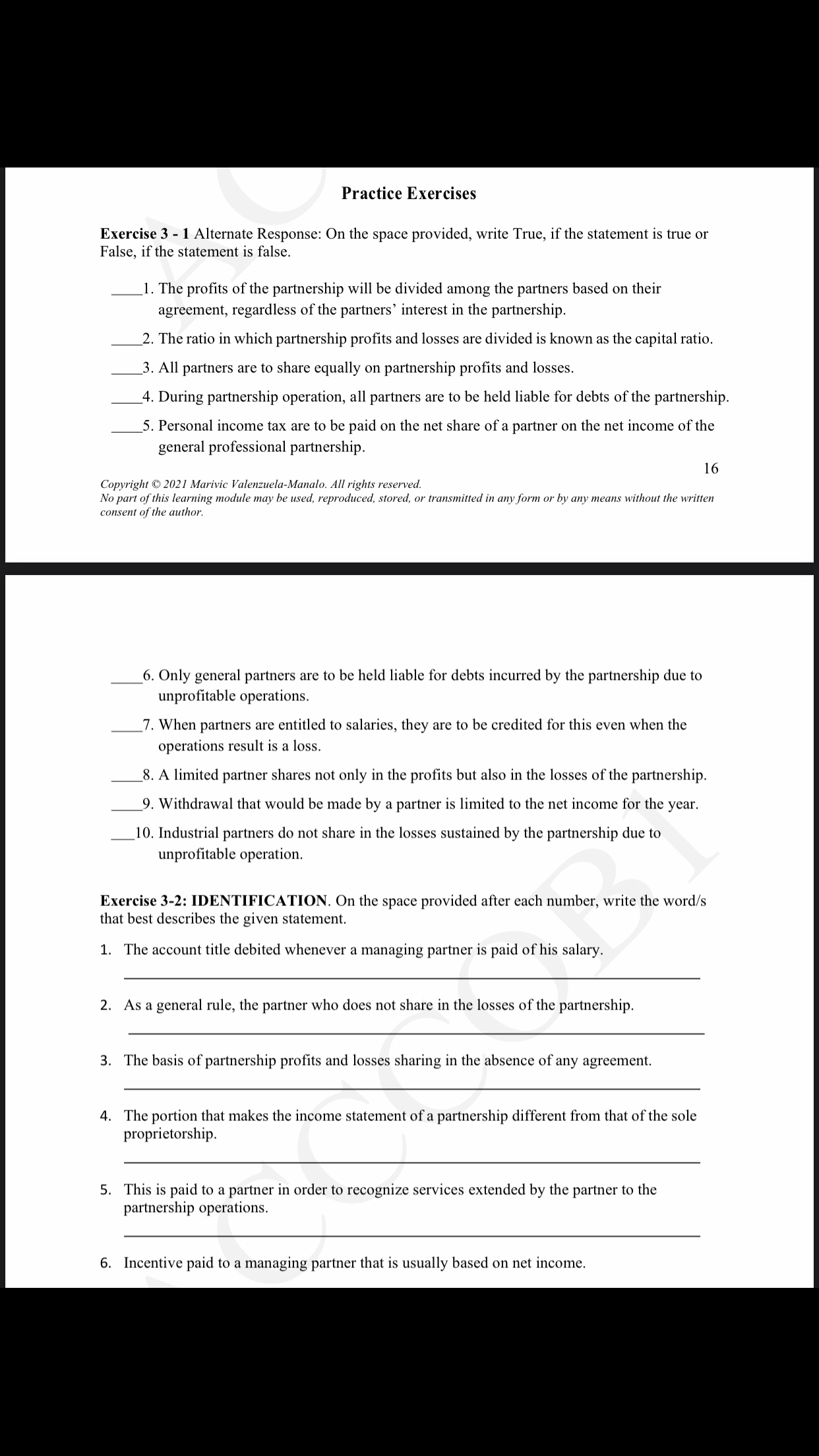

Practice Exercises Exercise 3 - 1 Alternate Response: On the space provided, write True, if the statement is true or False, if the statement is false. 1. The prots of the partnership will be divided among the partners based on their agreement, regardless of the partners' interest in the partnership. . The ratio in which partnership prots and losses are divided is known as the capital ratio. . During partnership operation, all partners are to be held liable for debts of the partnership. _2 73. All partners are to share equally on partnership prots and losses. 74 75 . Personal income tax are to be paid on the net share of a partner on the net income of the general professional partnership 1 6 Copyright 202] Marivic Valenzuela-Mariam. A\" right: reserved. No part ofthis learning module may be used. reproduced, stored, or transmitted in anyform or by any means without the written consent ofthe author. 6. Only general partners are to be held liable for debts incurred by the partnership due to unprotable operations. 7. When partners are entitled to salaries, they are to be credited for this even when the operations result is a loss. 8. A limited partner shares not only in the prots but also in the losses of the partnership. 9. Withdrawal that would be made by a partner is limited to the net income for the year. _10. Industrial partners do not share in the losses sustained by the partnership due to unprotable operation. Exercise 3-2: IDENTIFICATION. 0n the space provided after each number, write the word/s that best describes the given statement. 1. The account title debited whenever a managing partner is paid of his salary. As a general rule, the partner who does not share in the losses of the partnership. The basis of partnership profits and losses sharing in the absence of any agreement. The portion that makes the income statement of a partnership different from that of the sole proprietorship. This is paid to a partner in order to recognize services extended by the partner to the partnership operations. Incentive paid to a managing partner that is usually based on net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts