Question: Practice Final Exam - Selected Questions.pdf - Adobe Acrobat Reader DC X File Edit View Window Help Weblio Home Tools Practice Final Exam... X (?

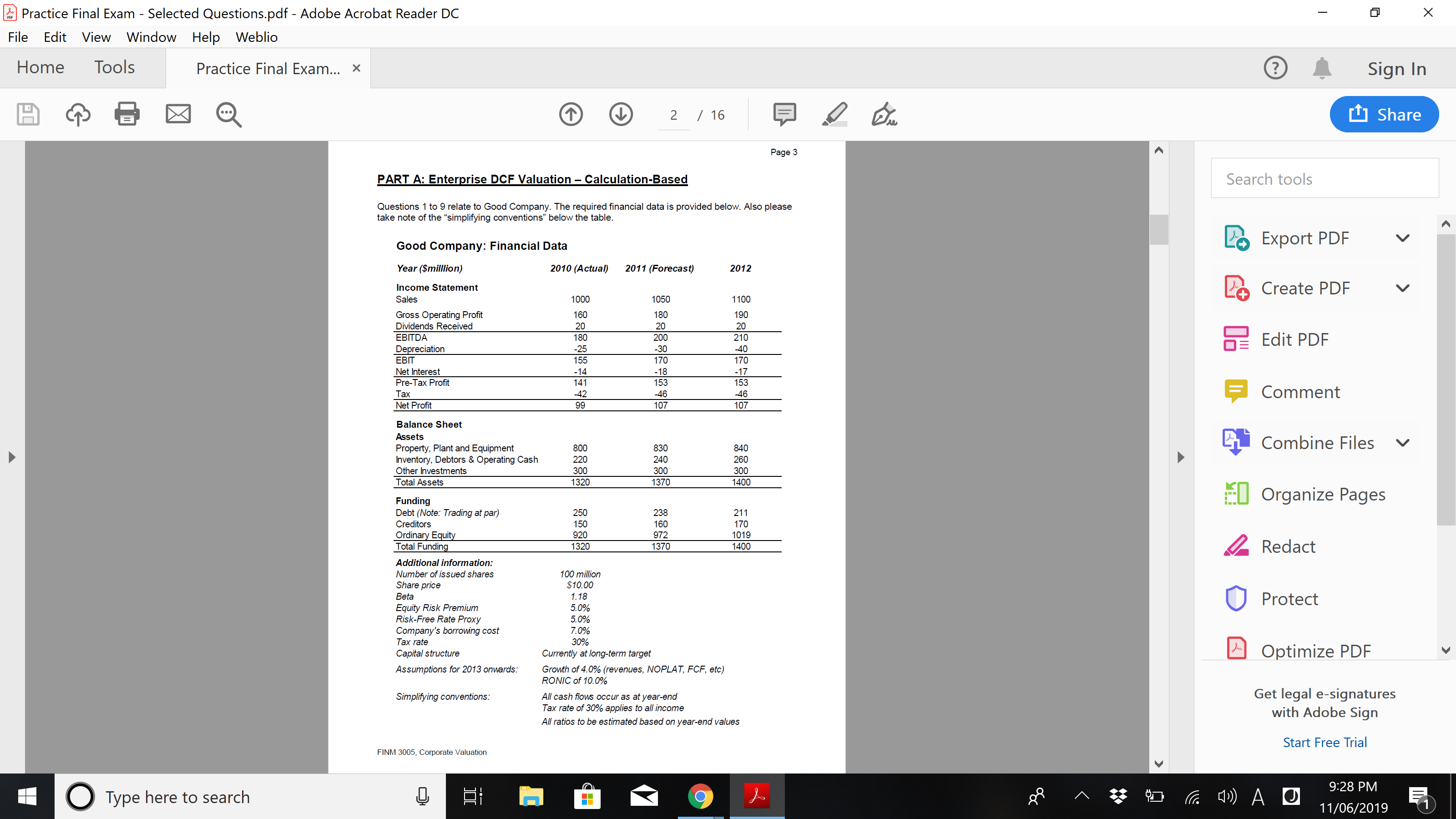

Practice Final Exam - Selected Questions.pdf - Adobe Acrobat Reader DC X File Edit View Window Help Weblio Home Tools Practice Final Exam... X (? Sign In X 2 / 16 Share Page 3 PART A: Enterprise DCF Valuation - Calculation-Based Search tools Questions 1 to 9 relate to Good Company. The required financial data is provided below. Also please take note of the "simplifying conventions" below the table. Good Company: Financial Data Export PDF V Year ($milllion) 2010 (Actual) 2011 (Forecast) 2012 Income Statement Sales 1000 1050 1100 Create PDF V Gross Operating Profit 160 Dividends Received 20 EBITDA 180 Depreciation -25 200 DE Edit PDF EBIT 155 Net Interest -14 170 Pre-Tax Profit 141 - 18 Tax -42 153 99 -46 107 = Net Profit Comment Balance Sheet Assets Property, Plant and Equipment Combine Files v Inventory, Debtors & Operating Cash 300 220 830 240 840 260 Other Investments 300 300 300 Total Assets 1320 1370 1400 Funding Organize Pages Debt (Note: Trading at par) 250 238 211 Creditors 150 160 170 Ordinary Equity 920 Total Funding 1320 972 1370 1019 1400 Redact Additional information: Number of issued shares 100 million Share price $10.00 Beta 1.18 Equity Risk Premium 5.0% Protect Risk-Free Rate Proxy 5.0% Company's borrowing cost 7.0% Tax rate 30% Capital structure Currently at long-term target Optimize PDF Assumptions for 2013 onwards: Growth of 4.0% (revenues, NOPLAT, FCF, etc) RONIC of 10.0% Simplifying conventions: All cash flows occur as at year-end Get legal e-signatures Tax rate of 30% applies to all income All ratios to be estimated based on year-end values with Adobe Sign FINM 3005, Corporate Valuation Start Free Trial O Type here to search M " ) A D 9:28 PM 11/06/2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts