Question: Practice Homework Due Ending Week 8 General: a large paper company, mentioned the below following question and choices for you. Use your accounting knowledge to

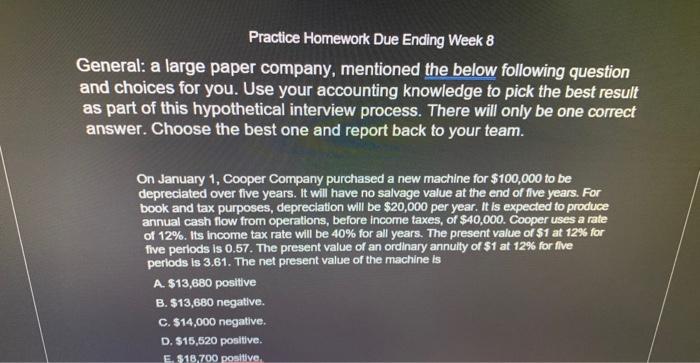

Practice Homework Due Ending Week 8 General: a large paper company, mentioned the below following question and choices for you. Use your accounting knowledge to pick the best result as part of this hypothetical interview process. There will only be one correct answer. Choose the best one and report back to your team. On January 1, Cooper Company purchased a new machine for $100,000 to be depreciated over five years. It will have no salvage value at the end of tive years. For book and tax purposes, depreciation will be $20,000 per year. It is expected to produce annual cash fiow from operations, before income taxes, of $40,000. Cooper uses a rate of 12%. Its income tax rate will be 40% for all years. The present value of $1 at 12% for five perlods is 0.57. The present value of an ordinary annuity of $1 at 12% for five periods is 3.61. The net present value of the machine is A. $13,680 positive B. $13,680 negative. C. $14,000 negative. D. 515,520 posittive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts