Question: Practice Makes Perfect 10 Calculating Canada Pension Plan 1. John's gross pay is $43 000.00/year. a. What is his CPP contribution for one year? 43

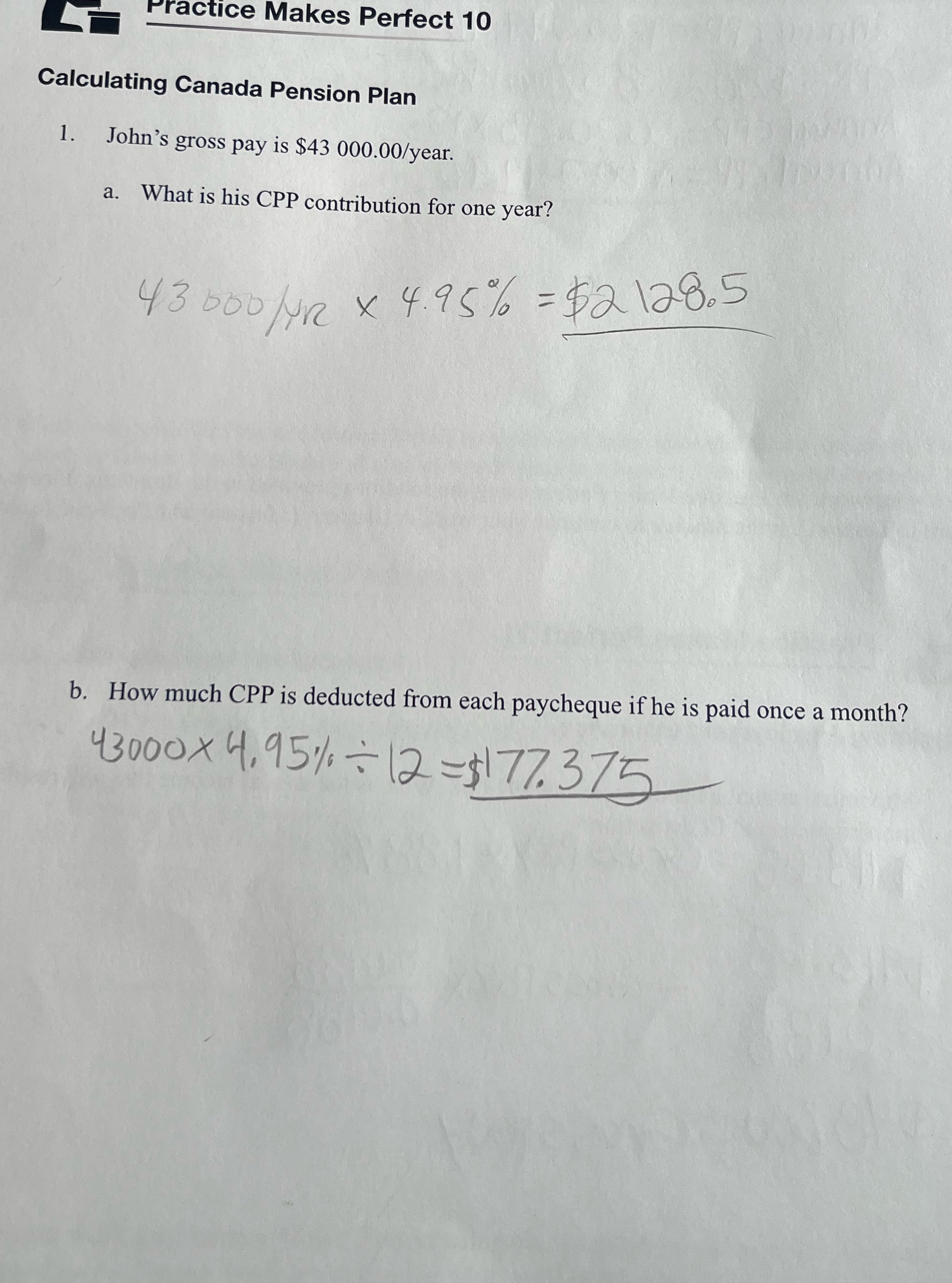

Practice Makes Perfect 10 Calculating Canada Pension Plan 1. John's gross pay is $43 000.00/year. a. What is his CPP contribution for one year? 43 060 / UR x 4.95% = $2 128.5 b. How much CPP is deducted from each paycheque if he is paid once a month? 43000 x 4. 95%%: 12= $177. 375

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts