Question: practice prob. 2, solutions 2.a. and 2.b. Please help. Thanks. Chapter 6Working Capital and the Financing Decision Otis Resources is trying to develop an asset

practice prob. 2, solutions 2.a. and 2.b. Please help. Thanks.

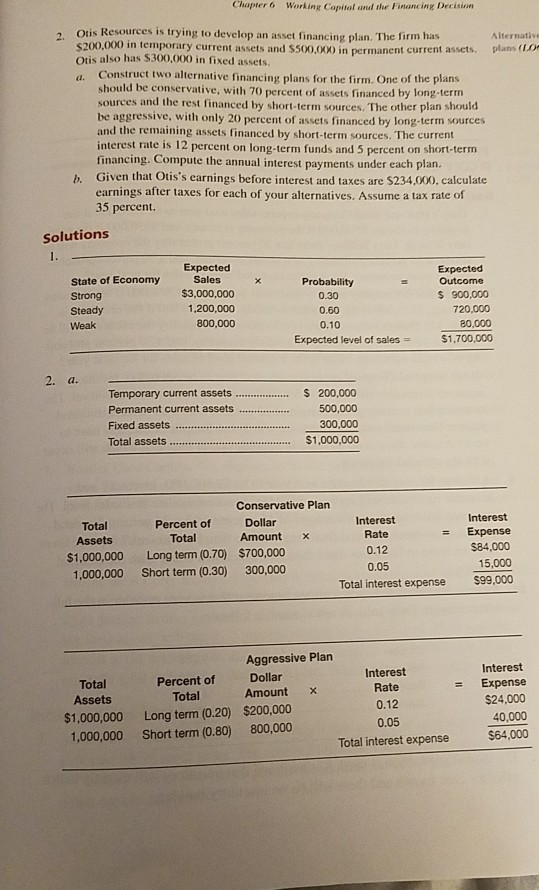

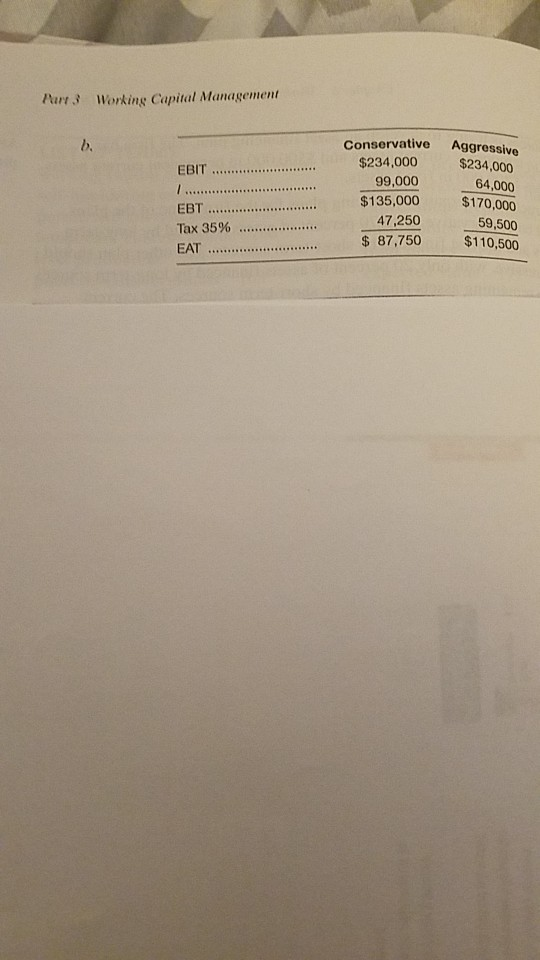

Chapter 6Working Capital and the Financing Decision Otis Resources is trying to develop an asset financing plan. The firm has $200,000 in temporary current assets and $500,000 in permanent current assets. Otis also has $300,000 in fixed assets a. Construct two alternative financing plans for the firm. One of the plans 2. Alternative plans (LO should be conservative, with 70 percent of assets financed by long-term sources and the rest financed by short-term sources. The other plan should be aggressive, with only 20 percent of assets financed by long-term sources and the remaining assets financed by short-term sources. The current interest rate is 12 percent on long-term funds and 5 percent on short-term financing. Compute the annual interest payments under each plan. Given that Otis's earnings before interest and taxes are $234,000, calculate earnings after taxes for each of your alternatives. Assume a tax rate of 35 percent. b. Solutions State of Economy Strong Steady Weak Expected Sales $3,000,000 1,200,000 Probability 0.30 0.60 0.10 Outcome s 900,000 720,000 80,000 $1,700,000 800,000 Expected level of sales = al. Temporary current assets....S 200,000 Permanent current assets .. Fixed assets Total assets 500,000 300,000 $1,000,000 Conservative Plan Interest Rate 0.12 0.05 Total Assets Percent of Total Dollar Amountx = Expense $84,000 15,000 Total interest expense $99,000 $1,000,000 Long term (0.70) $700,000 1,000,000 Short term (0.30) 300,000 Aggressive Plan Interest Rate 0.12 0.05 Interest - Expense $24,000 40,000 $64,000 Total Assets Percent of Total Dollar Amount x $1,000,000 Long term (0.20) $200,000 1,000,000 Short term (0.80) 800,000 Total interest expense Par Working Capital Management Conservative Aggressive $234,000 64,000 $170,000 59,500 $110,500 b. EBIT $234,000 99,000 EBT. Tax 3596 47,250 $ 87,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts