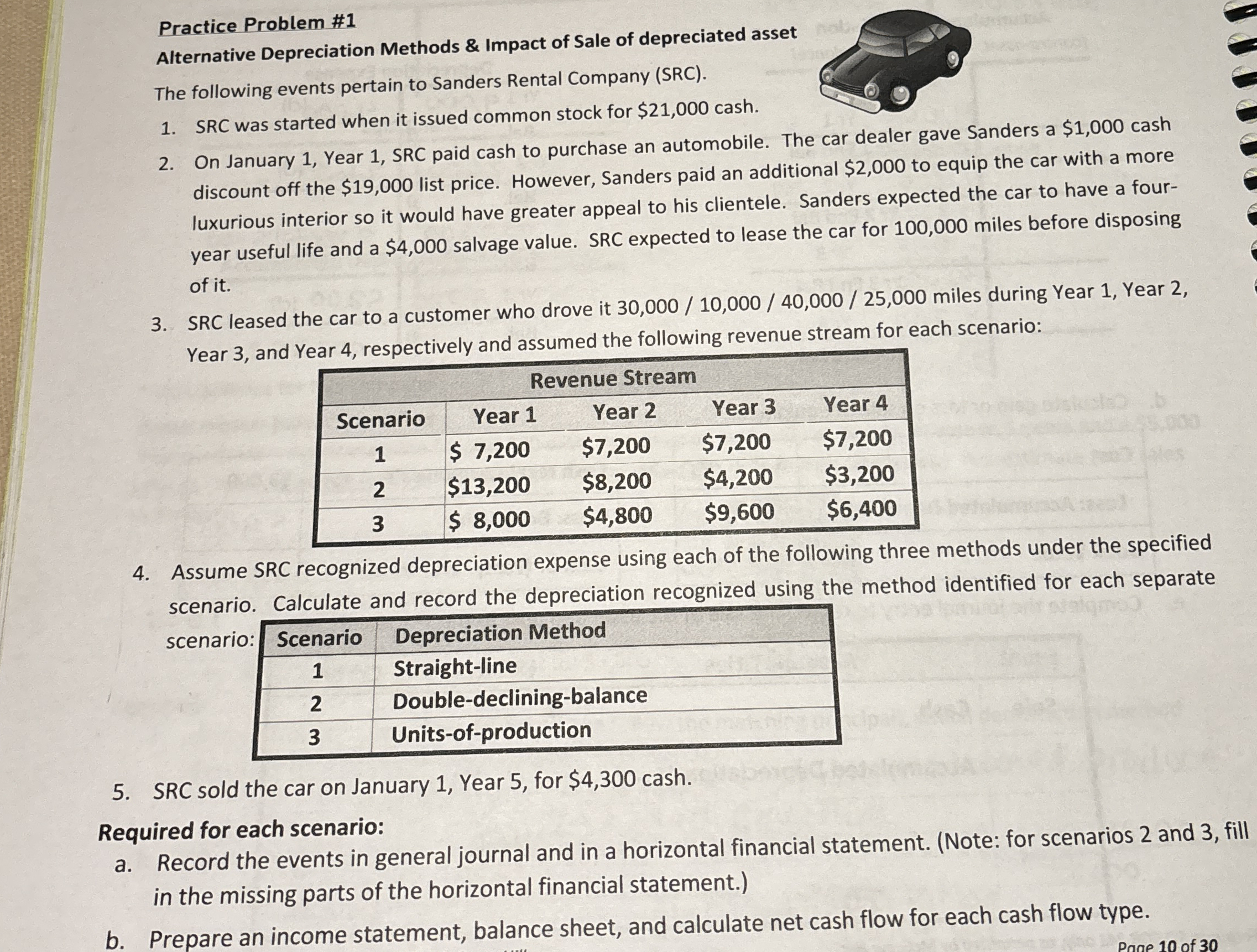

Question: Practice Problem # 1 Alternative Depreciation Methods & Impact of Sale of depreciated asset The following events pertain to Sanders Rental Company ( SRC )

Practice Problem #

Alternative Depreciation Methods & Impact of Sale of depreciated asset

The following events pertain to Sanders Rental Company SRC

SRC was started when it issued common stock for $ cash.

On January Year SRC paid cash to purchase an automobile. The car dealer gave Sanders a $ cash discount off the $ list price. However, Sanders paid an additional $ to equip the car with a more luxurious interior so it would have greater appeal to his clientele. Sanders expected the car to have a fouryear useful life and a $ salvage value. SRC expected to lease the car for miles before disposing of it

SRC leased the car to a customer who drove it miles during Year Year Year and Year respectively and assumed the following revenue stream for each scenario:

tableRevenue StreamScenarioYear Year Year Year $$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock