Question: Practice Problem 16-01 (Part Level Submission) On January 1, 2016, Sheridan Company issued 10-year, $100,000 face value, 6% bonds at par (interest payable annually on

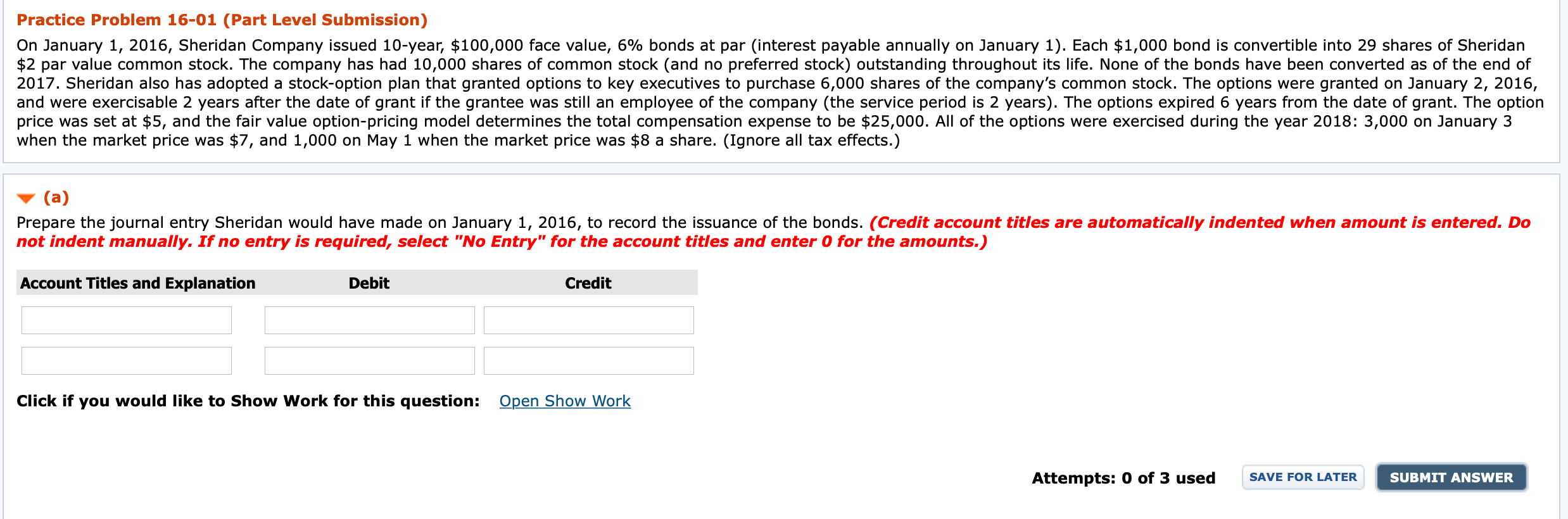

Practice Problem 16-01 (Part Level Submission) On January 1, 2016, Sheridan Company issued 10-year, $100,000 face value, 6% bonds at par (interest payable annually on January 1). Each $1,000 bond is convertible into 29 shares of Sheridan $2 par value common stock. The company has had 10,000 shares of common stock (and no preferred stock) outstanding throughout its life. None of the bonds have been converted as of the end of 2017. Sheridan also has adopted a stock-option plan that granted options to key executives to purchase 6,000 shares of the company's common stock. The options were granted on January 2, 2016, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company (the service period is 2 years). The options expired 6 years from the date of grant. The option price was set at $5, and the fair value option-pricing model determines the total compensation expense to be $25,000. All of the options were exercised during the year 2018: 3,000 on January 3 when the market price was $7, and 1,000 on May 1 when the market price was $8 a share. (Ignore all tax effects.) (a) Prepare the journal entry Sheridan would have made on January 1, 2016, to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Click if you would like to Show Work for this question: Open Show Work Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts