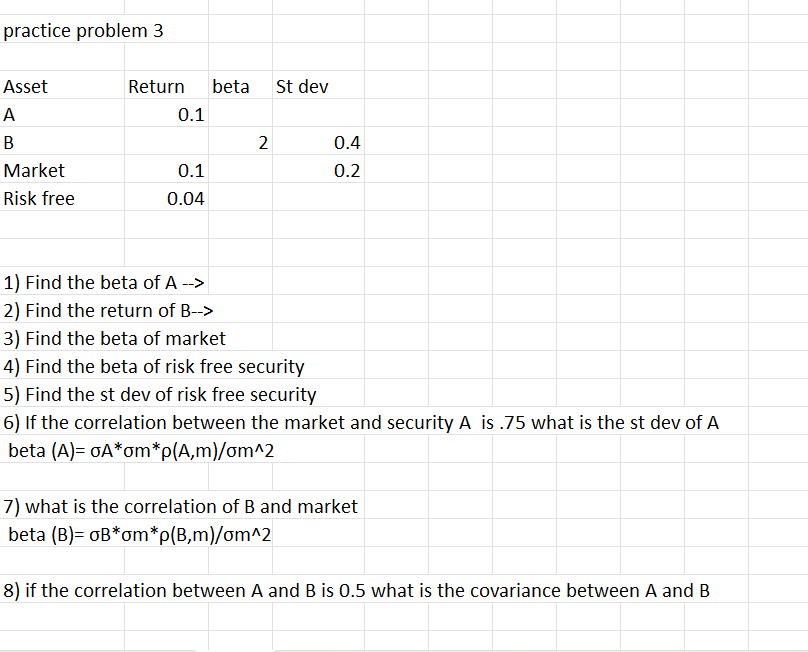

Question: practice problem 3 Asset Return beta St dev A 0 . 1 B 2 0 . 4 Market 0 . 1 0 . 2 Risk

practice problem

Asset Return beta St dev

A

B

Market

Risk free

Find the beta of A

Find the return of B

Find the beta of market

Find the beta of risk free security

Find the st dev of risk free security

If the correlation between the market and security A is what is the st dev of A

beta Asigma Asigma mrho Amsigma m

what is the correlation of B and market

beta Bsigma Bsigma mrho Bmsigma m

if the correlation between A and B is what is the covariance between A and B

what is the st dev of the portfolio with of the money is risk free security and rest in A

what is the return of that portfolio

what are the Xa and Xb which will lead to minimum variance portfolio of just A and B ignore earlier correlation number and assume corrA B

minimum variance will be or y axis

you want to make the most efficient portfolio remember the CML capital market line

you want the portfolio return to be

you have dollars which security you will use and what will be your allocation of money to each security

beta Asigma amsigma m

covariance of return of Am Variance of m

where a is the security whose equities beta is calculated and m is the market

beta Asigma Aif the correlation between A and is what is the covariance between A and Bsigma mrho Amsigma m

beta of equity of security A

capm formula also known as capital asset pricing model

Era rf betaArmrf

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock