Question: Practice Problem 3 Comprehensive exercise with sales discounts Junker's Stash started the Year 2 accounting period with the following balances: During Year 2 , Junker's

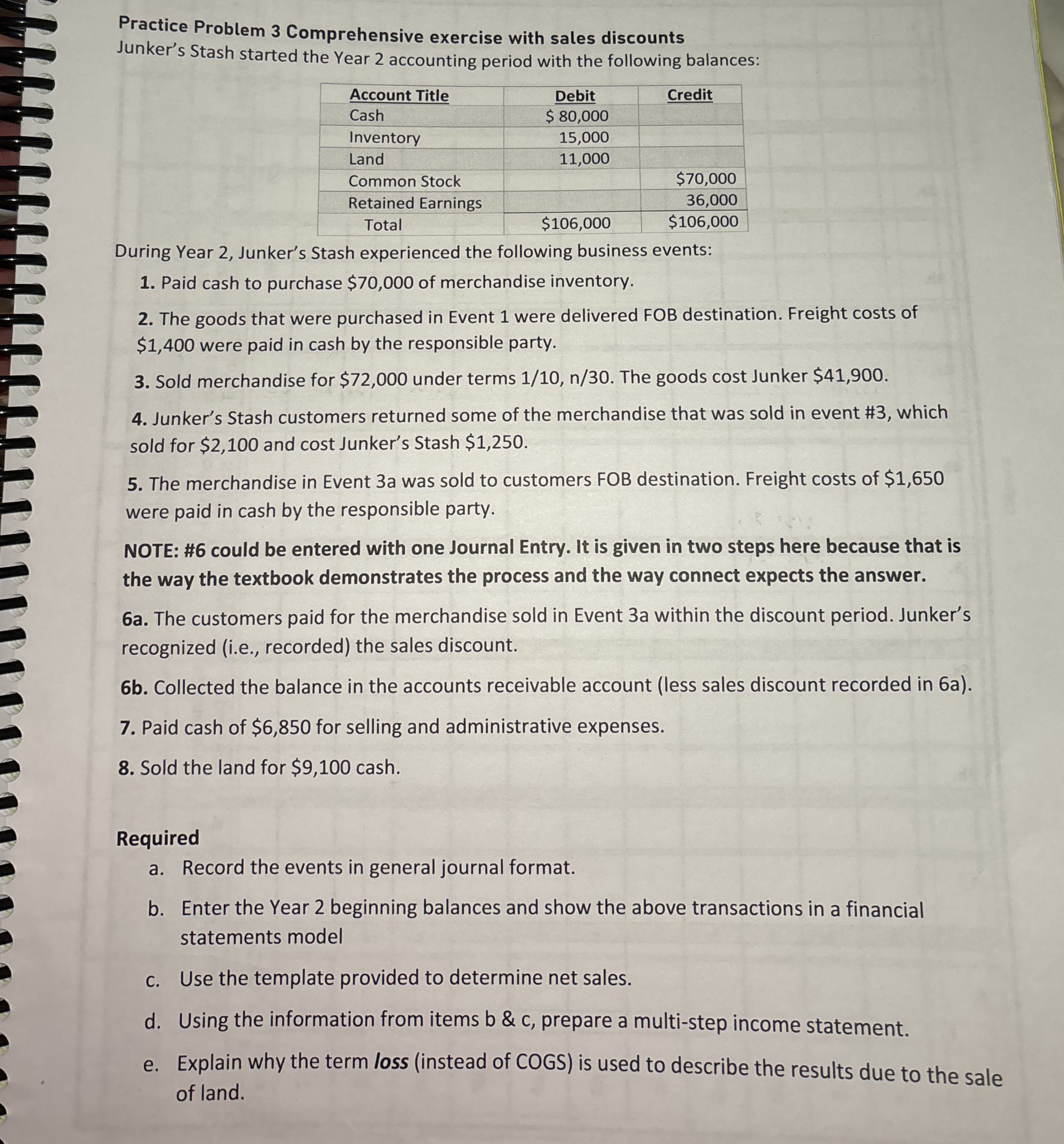

Practice Problem Comprehensive exercise with sales discounts

Junker's Stash started the Year accounting period with the following balances:

During Year Junker's Stash experienced the following business events:

Paid cash to purchase $ of merchandise inventory.

The goods that were purchased in Event were delivered FOB destination. Freight costs of

$ were paid in cash by the responsible party.

Sold merchandise for $ under terms The goods cost Junker $

Junker's Stash customers returned some of the merchandise that was sold in event # which

sold for $ and cost Junker's Stash $

The merchandise in Event a was sold to customers FOB destination. Freight costs of $

were paid in cash by the responsible party.

NOTE: # could be entered with one Journal Entry. It is given in two steps here because that is

the way the textbook demonstrates the process and the way connect expects the answer.

a The customers paid for the merchandise sold in Event a within the discount period. Junker's

recognized ie recorded the sales discount.

b Collected the balance in the accounts receivable account less sales discount recorded in a

Paid cash of $ for selling and administrative expenses.

Sold the land for $ cash.

Required

a Record the events in general journal format.

b Enter the Year beginning balances and show the above transactions in a financial

statements model

c Use the template provided to determine net sales.

d Using the information from items b & c prepare a multistep income statement.

e Explain why the term loss instead of COGS is used to describe the results due to the sale

of land.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock