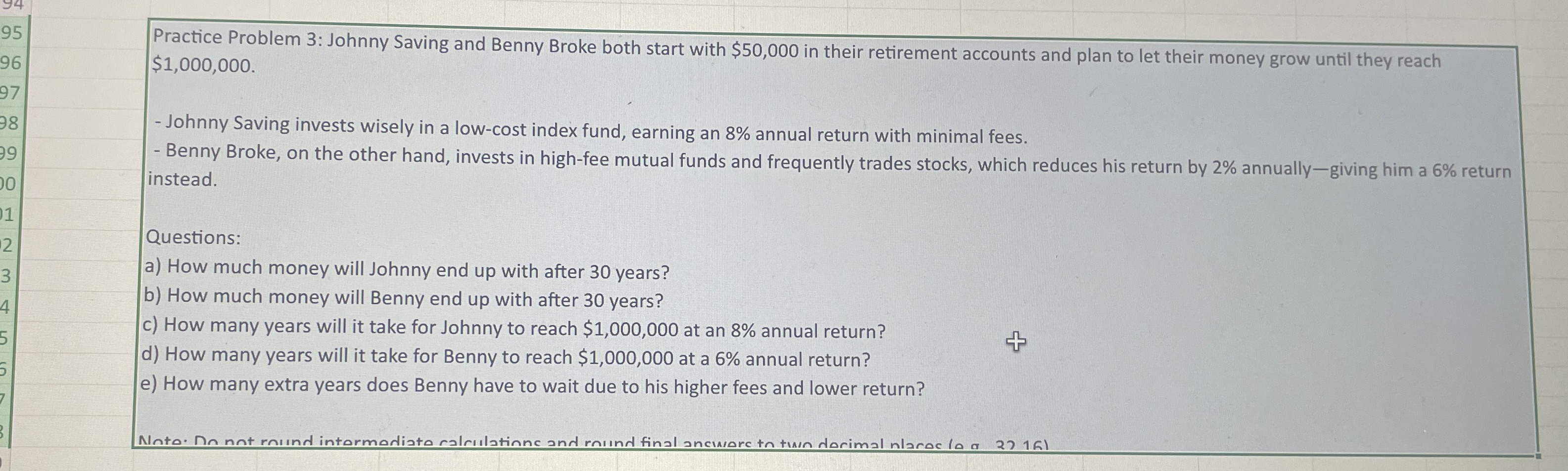

Question: Practice Problem 3 : Johnny Saving and Benny Broke both start with $ 5 0 , 0 0 0 in their retirement accounts and plan

Practice Problem : Johnny Saving and Benny Broke both start with $ in their retirement accounts and plan to let their money grow until they reach $

Johnny Saving invests wisely in a lowcost index fund, earning an annual return with minimal fees.

Benny Broke, on the other hand, invests in highfee mutual funds and frequently trades stocks, which reduces his return by annuallygiving him a return instead.

Questions:

a How much money will Johnny end up with after years?

b How much money will Benny end up with after years?

c How many years will it take for Johnny to reach $ at an annual return?

d How many years will it take for Benny to reach $ at a annual return?

e How many extra years does Benny have to wait due to his higher fees and lower return?

Nato. No nat raund intormodiato ralrulatinnc and round final ancimoretntimen darimal nlarac a f

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock