Question: Practice problem 9 part 1 and 2. I would really apreciate the help, I will give a review if the question is answered with an

Practice problem 9 part 1 and 2. I would really apreciate the help, I will give a review if the question is answered with an explination. Thank you.

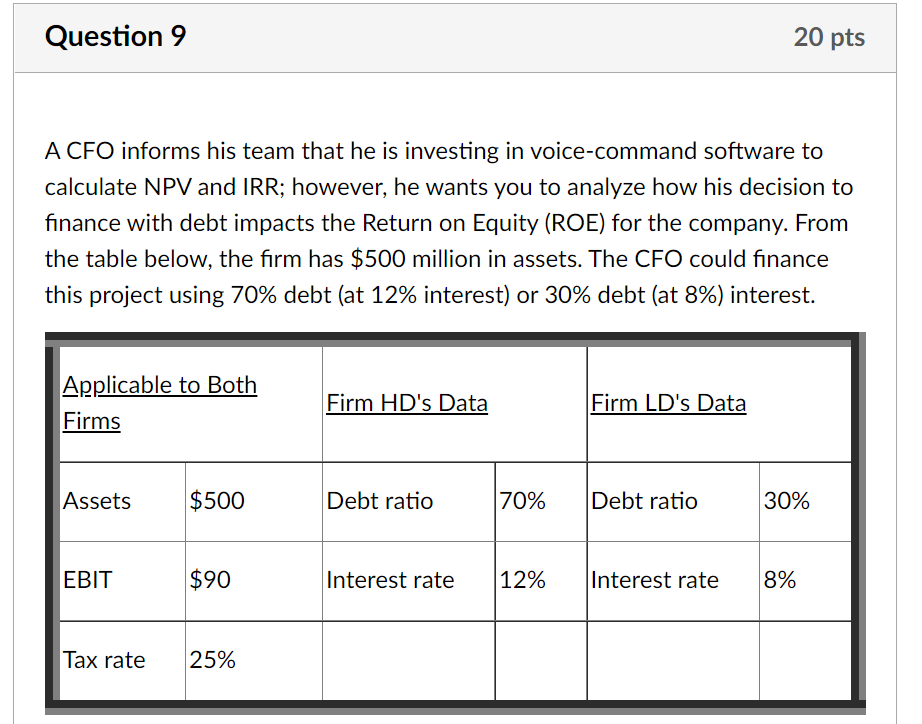

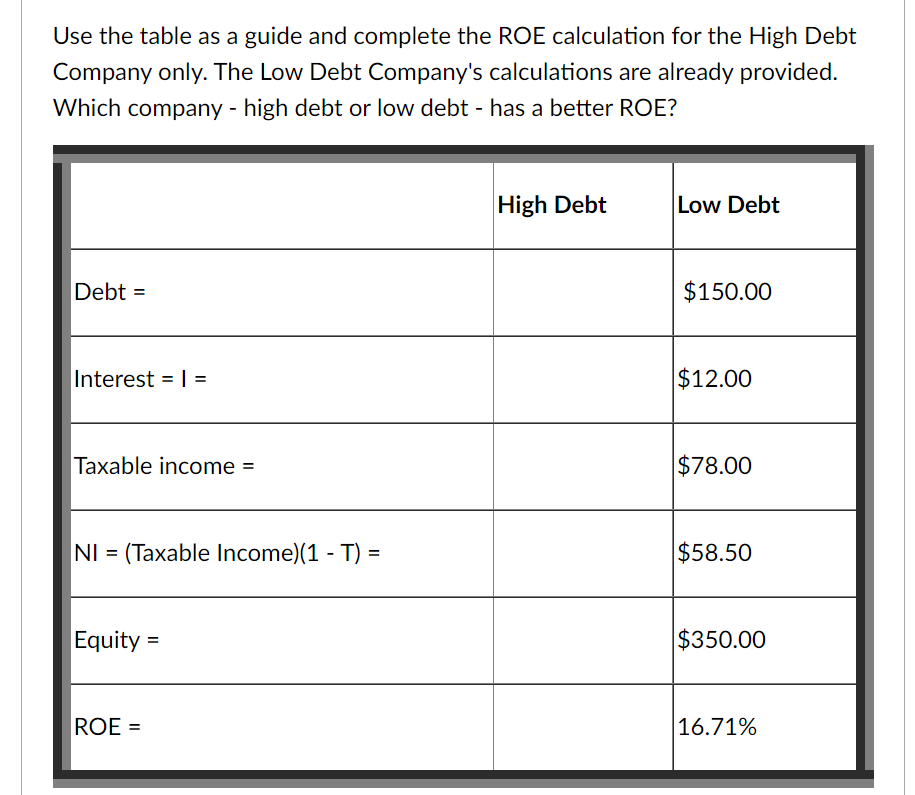

A CFO informs his team that he is investing in voice-command software to calculate NPV and IRR; however, he wants you to analyze how his decision to finance with debt impacts the Return on Equity (ROE) for the company. From the table below, the firm has $500 million in assets. The CFO could finance this project using 70% debt (at 12% interest) or 30% debt (at 8% ) interest. Use the table as a guide and complete the ROE calculation for the High Debt Company only. The Low Debt Company's calculations are already provided. Which company - high debt or low debt - has a better ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts