Question: Practice Problem - Adjusting Entries Prepared Annually Cami Company has the following balances in select accounts on December 31, 2021. All accounts have normal

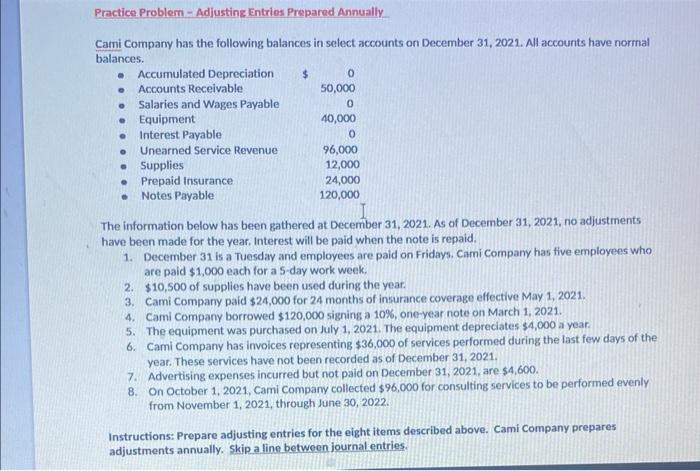

Practice Problem - Adjusting Entries Prepared Annually Cami Company has the following balances in select accounts on December 31, 2021. All accounts have normal balances. Accounts Receivable Salaries and Wages Payable Equipment Accumulated Depreciation $ 0 50,000 0 40,000 Interest Payable 0 Unearned Service Revenue Supplies 96,000 12,000 Prepaid Insurance 24,000 Notes Payable 120,000 The information below has been gathered at December 31, 2021. As of December 31, 2021, no adjustments have been made for the year. Interest will be paid when the note is repaid. 1. December 31 is a Tuesday and employees are paid on Fridays. Cami Company has five employees who are paid $1,000 each for a 5-day work week. 2. $10,500 of supplies have been used during the year. 3. Cami Company paid $24,000 for 24 months of insurance coverage effective May 1, 2021. 4. Cami Company borrowed $120,000 signing a 10%, one-year note on March 1, 2021. 5. The equipment was purchased on July 1, 2021. The equipment depreciates $4,000 a year. 6. Cami Company has invoices representing $36,000 of services performed during the last few days of the year. These services have not been recorded as of December 31, 2021. 7. Advertising expenses incurred but not paid on December 31, 2021, are $4,600. 8. On October 1, 2021, Cami Company collected $96,000 for consulting services to be performed evenly from November 1, 2021, through June 30, 2022. Instructions: Prepare adjusting entries for the eight items described above. Cami Company prepares adjustments annually. Skip a line between journal entries.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts