Question: Practice Problem - Hedging with Options - Consider an investor who owns 1,000 shares of a stock. The share price is $150 per share. The

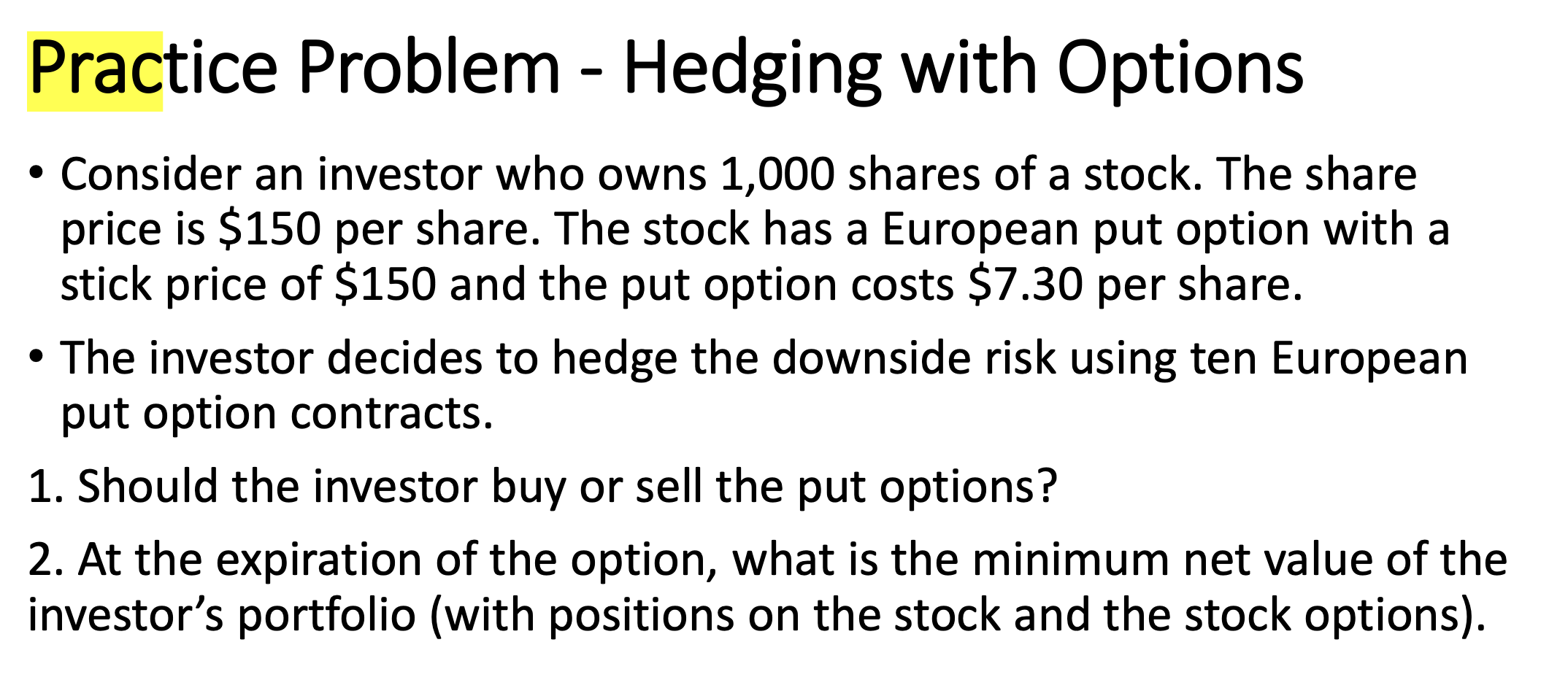

Practice Problem - Hedging with Options - Consider an investor who owns 1,000 shares of a stock. The share price is \$150 per share. The stock has a European put option with a stick price of $150 and the put option costs $7.30 per share. - The investor decides to hedge the downside risk using ten European put option contracts. 1. Should the investor buy or sell the put options? 2. At the expiration of the option, what is the minimum net value of the investor's portfolio (with positions on the stock and the stock options)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts