Question: Practice Problem - Macrohedging with Futures - A bank has assets of $150 million, liabilities of $120 million, and equity of $30 million. The asset

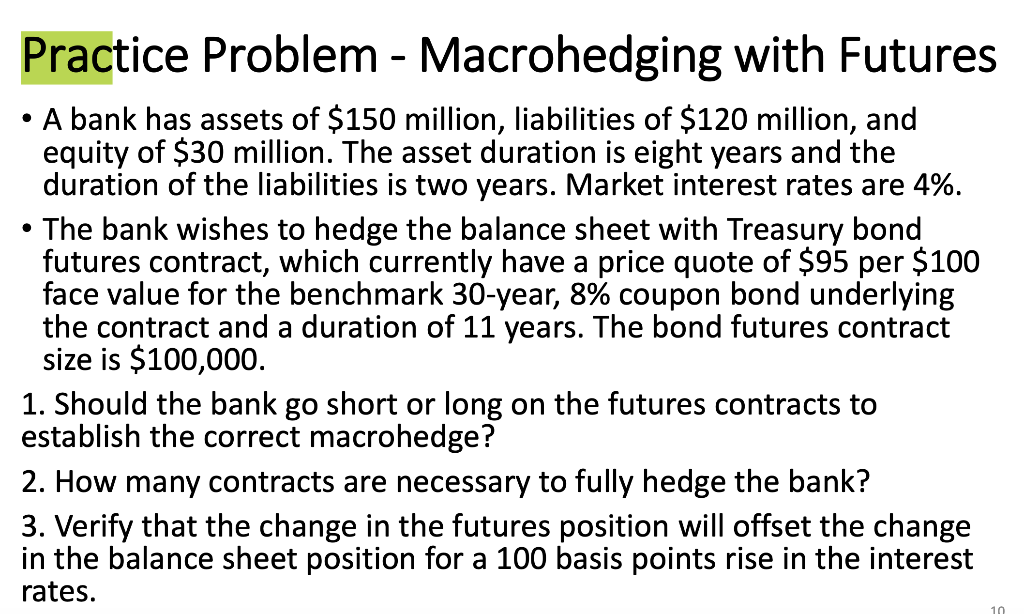

Practice Problem - Macrohedging with Futures - A bank has assets of \$150 million, liabilities of $120 million, and equity of $30 million. The asset duration is eight years and the duration of the liabilities is two years. Market interest rates are 4%. - The bank wishes to hedge the balance sheet with Treasury bond futures contract, which currently have a price quote of $95 per $100 face value for the benchmark 30 -year, 8% coupon bond underlying the contract and a duration of 11 years. The bond futures contract size is $100,000. 1. Should the bank go short or long on the futures contracts to establish the correct macrohedge? 2. How many contracts are necessary to fully hedge the bank? 3. Verify that the change in the futures position will offset the change in the balance sheet position for a 100 basis points rise in the interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts