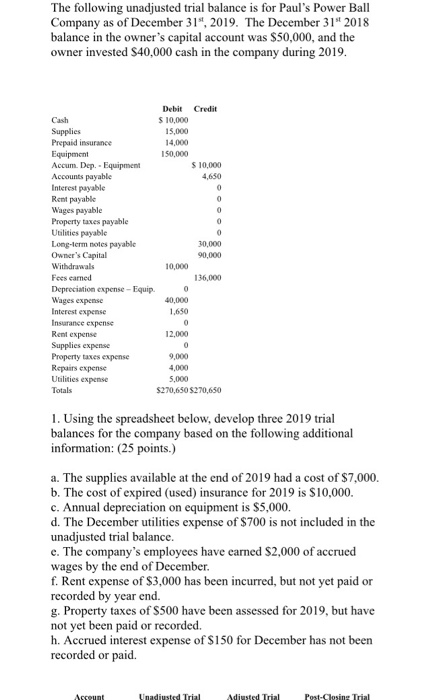

Question: Practice problem please help! The following unadjusted trial balance is for Paul's Power Ball Company as of December 31t, 2019. The December 31s 2018 balance

Practice problem please help!

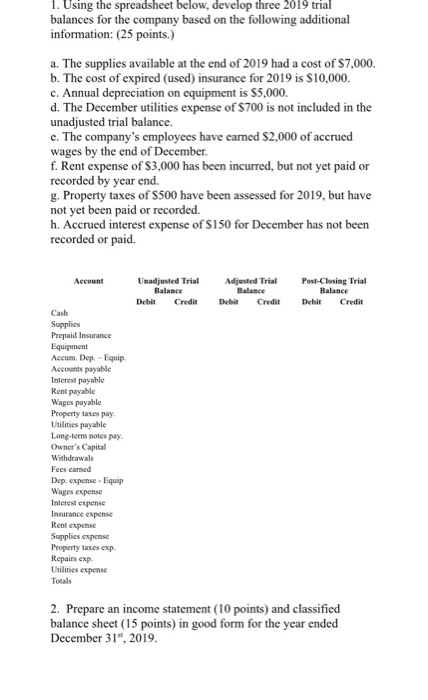

Practice problem please help!The following unadjusted trial balance is for Paul's Power Ball Company as of December 31t, 2019. The December 31s 2018 balance in the owner's capital account was $50,000, and the owner invested $40,000 cash in the company during 2019 Debit Credit Cash $ 10,000 15,000 4,000 150,000 Prepaid insurance Accum. Dep.-Equipment Accounts payable Interest payable Rent payable Wages payable Property taxes payable Usilities payable Long-lerm notes payable Owner's Capital S 10,000 4,650 30,000 Fees earned Depreciation expense-Equip. Wages expense Interest expense Insarance expense Rent expense Supplies expense Property taxes expense Repairs expense Utilities expense 136,000 1,650 9,000 4,000 $270,650$270,650 1. Using the spreadsheet below, develop three 2019 trial balan information: (25 points.) ces for the company based on the following additional a. The supplies available at the end of 2019 had a cost of $7,000 b. The cost of expired (used) insurance for 2019 is $10,000 c. Annual depreci d. The December utilities expense of $700 is not included in the unadjusted trial balance. e. The company's employees have earned S2,000 of accrued wages by the end of December f. Rent expense of $3,000 has been incurred, but not yet paid or recorded by year end. g. Property taxes of S500 have been assessed for 2019, but have not yet been paid or recorded. h. Accrued interest expense of S150 for December has not been recorded or paid. iation on equipment is $5,000. 1. Using the spreadsheet below, develop three 2019 trial balances for the company based on the following additional information: (25 points.) a. The supplies available at the end of 2019 had a cost of $7,000. b. The cost of expired (used) insurance for 2019 is S10,000 c. Annual depreciation on equipment is $5,000 d. The December utilities e unadjusted trial balance. c. The company's employees have earned S2,000 of accrued wages by the end of December. f. Rent expense of $3,000 has been incurred, but not yet paid or recorded by year end g. Property taxes of S500 have been assessed for 2019, but have not yet been paid or recorded. h. Accrued interest expense of S150 for December has not been recorded or paid. xpense of $700 is not included in the Adjusted Trial Balance Post-Closing Trial Balance Debit Credit Account Unadjusted Trial Balance Debit Credit Dbit Credit Cash Prepaid Insurance Accum. Dep. Equip Accounts payable Interest payable Rent payable Wages payable Property taxes pay Utilities payable Long-terms notes pay. Owner's Capital Withdrawals Fees earned Dep. expense-Equip Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes exp. Repairs exp Utilities expense 2. Prepare an income statement (10 points) and classified balance sheet (15 points) in good form for the year ended December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts