Question: Practice Problem Suppose that today a US company knows that the company will pay 1 million in 6 months and wants to hedge against exchange

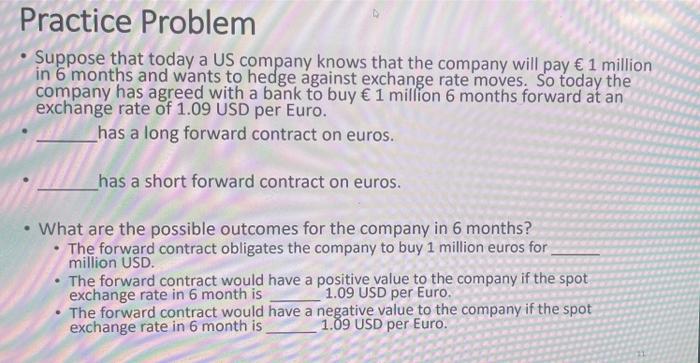

Practice Problem Suppose that today a US company knows that the company will pay 1 million in 6 months and wants to hedge against exchange rate moves. So today the company has agreed with a bank to buy 1 million 6 months forward at an exchange rate of 1.09 USD per Euro. has a long forward contract on euros. has a short forward contract on euros. What are the possible outcomes for the company in 6 months? The forward contract obligates the company to buy 1 million euros for million USD. The forward contract would have a exchange rate in 6 month is positive value to the company if the spot 1.09 USD per Euro. The forward contract would have a exchange rate in 6 month is negative value to the company if the spot 1.09 USD per Euro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts