Question: practice problems are hard! ir. th ir ar nts - Requirements 1. Compute Air Asias's first-year depreciation expense on the plane using the following methods:

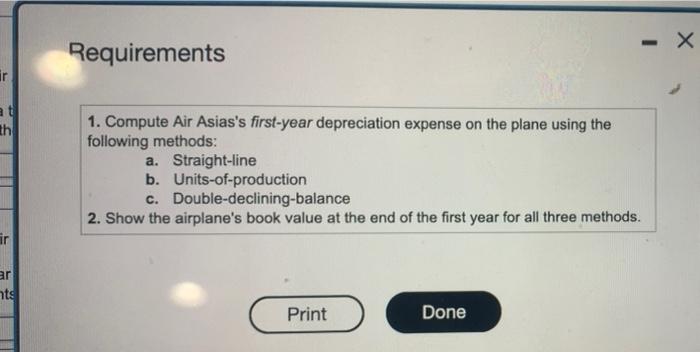

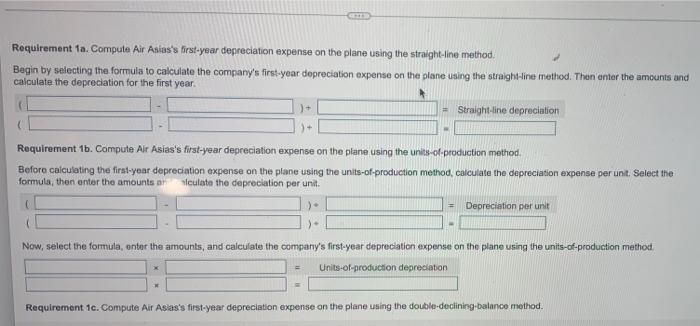

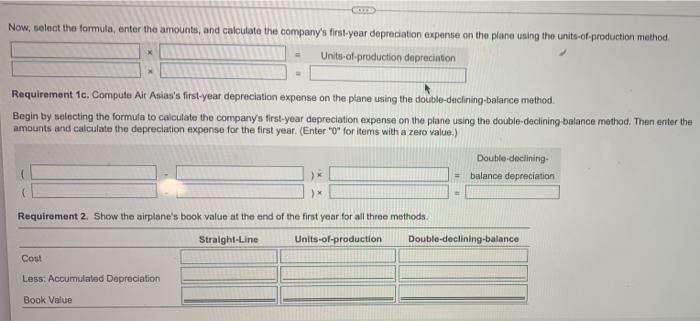

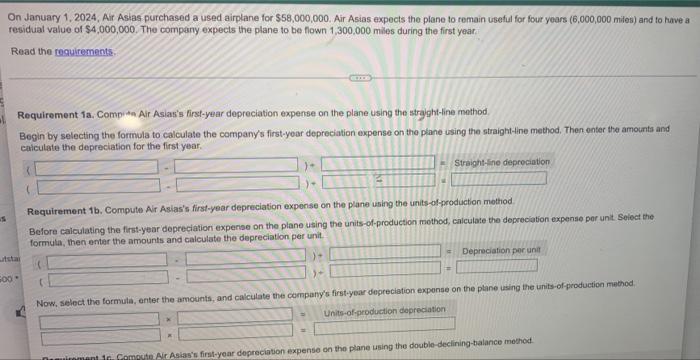

ir. th ir ar nts - Requirements 1. Compute Air Asias's first-year depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year for all three methods. Print Done X Requirement 1a. Compute Air Asias's first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year. )+ Straight-line depreciation W Requirement 1b. Compute Air Asias's first-year depreciation expense on the plane using the units-of-production method. Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts ar lculate the depreciation per unit. ). = Depreciation per unit Now, select the formula, enter the amounts, and calculate the company's first-year depreciation expense on the plane using the units-of-production method. x Units-of-production depreciation * Requirement 1c. Compute Air Asias's first-year depreciation expense on the plane using the double-declining-balance method. Care Now, select the formula, enter the amounts, and calculate the company's first-year depreciation expense on the plane using the units-of-production method. Units-of-production depreciation Requirement 1c. Compute Air Asias's first-year depreciation expense on the plane using the double-declining-balance method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the first year. (Enter "0" for items with a zero value.) Double-declining- = balance depreciation )* Requirement 2. Show the airplane's book value at the end of the first year for all three methods. Straight-Line Units-of-production Cost Less: Accumulated Depreciation Book Value Double-declining-balance On January 1, 2024, Air Asias purchased a used airplane for $58,000,000. Air Asias expects the plane to remain useful for four years (6,000,000 miles) and to have a residual value of $4,000,000. The company expects the plane to be flown 1,300,000 miles during the first year. Read the requirements. Requirement 1a. Comp Air Asias's first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year. Straight-line depreciation Requirement 1b. Compute Air Asias's first-year depreciation expense on the plane using the units-of-production method. S Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation per unit. utsta Depreciation per unit ( = 500. >- ( Now, select the formula, enter the amounts, and calculate the company's first-year depreciation expense on the plane using the units-of-production method. Units-of-production depreciation. X X Dairement 16. Compute Air Asias's first-year depreciation expense on the plane using the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts