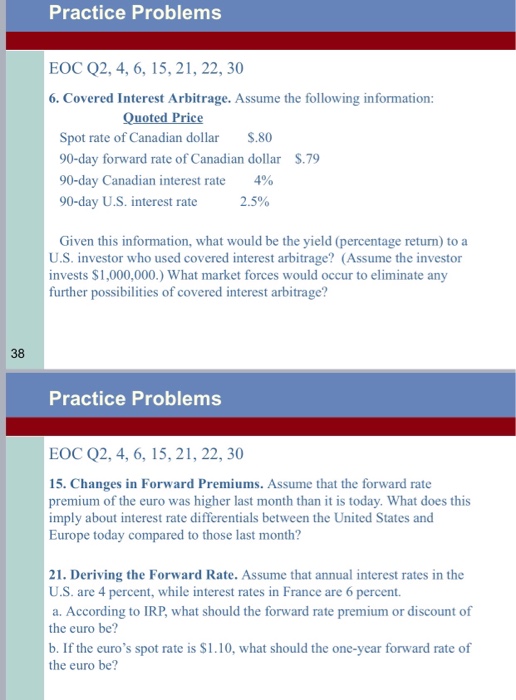

Question: Practice Problems EOC Q2, 4, 6, 15,21, 22, 30 6. Covered Interest Arbitrage. Assume the following information Pofed Pric Spot rate of Canadian dollar S.80

Practice Problems EOC Q2, 4, 6, 15,21, 22, 30 6. Covered Interest Arbitrage. Assume the following information Pofed Pric Spot rate of Canadian dollar S.80 90-day forward rate of Canadian dollar 90-day Canadian interest rate 4% 90-day U.S. interest rate 2.5% S.79 Given this information, what would be the yield (percentage return) to a U.S. investor who used covered interest arbitrage? (Assume the investor invests $1,000,000.) What market forces would occur to eliminate any further possibilities of covered interest arbitrage? 38 Practice Problems EOC Q2, 4, 6, 15, 21, 22, 30 15. Changes in Forward Premiums. Assume that the forward rate premium of the euro was higher last month than it is today. What does this imply about interest rate differentials between the United States and Europe today compared to those last month? 21. Deriving the Forward Rate. Assume that annual interest rates in the U.S. are 4 percent, while interest rates in France are 6 percent. a. According to IRP, what should the forward rate premium or discount of the euro be? b. If the euro's spot rate is S1.10, what should the one-year forward rate of the euro be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts