Question: Practice Problems EOC Questions 5, 7, 10, 11, 13, 14, 19, 20, 24, 25 20. Deriving Forecasts of the Future Spot Rate. As of today,

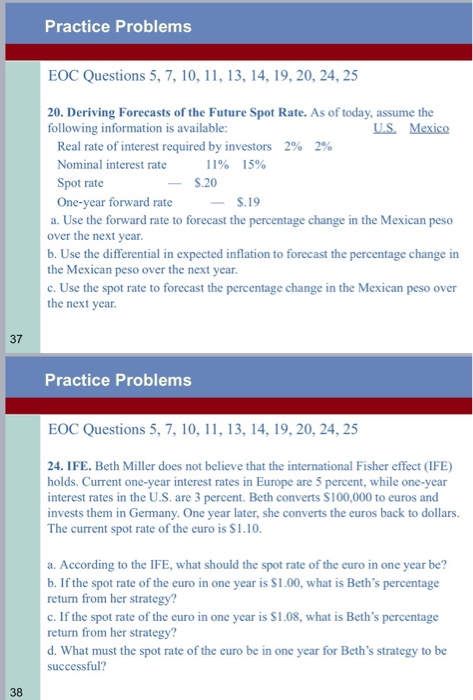

Practice Problems EOC Questions 5, 7, 10, 11, 13, 14, 19, 20, 24, 25 20. Deriving Forecasts of the Future Spot Rate. As of today, assume the following information is available: LS. Mexico 2% 2% Real rate of interest required by investors 15% 11% $.20 Nominal interest rate Spot rate -- S.19 One-year forward rate a. Use the forward rate to forecast the percentage change in the Mexican peso over the next year b. Use the differential in expected inflation to forecast the percentage change in the Mexican peso over the next year c. Use the spot rate to forecast the percentage change in the Mexican peso over the next year 37 Practice Problems EOC Questions 5, 7, 10, 11, 13, 14, 19, 20, 24, 25 24. IFE. Beth Miller does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Europe are 5 percent, while one-year interest rates in the U.S. are 3 percent. Beth converts $100,000 to euros and invests them in Germany. One year later, she converts the euros back to dollars. The current spot rate of the euro is S1.10. a. According to the IFE, what should the spot rate of the euro in one year be? b. If the spot rate of the euro in one year is $1.00, what is Beth's percentage return from her strategy? c. If the spot rate of the euro in one year is $1.08, what is Beth's percentage return from her strategy? d. What must the spot rate of the euro be in one year for Beth's strategy to be successful? 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts