Question: Practice Problems for Futures Contracts Specs and Margins - Part 1 1 Using information from the CME Group website, determine the tick size tiek ve

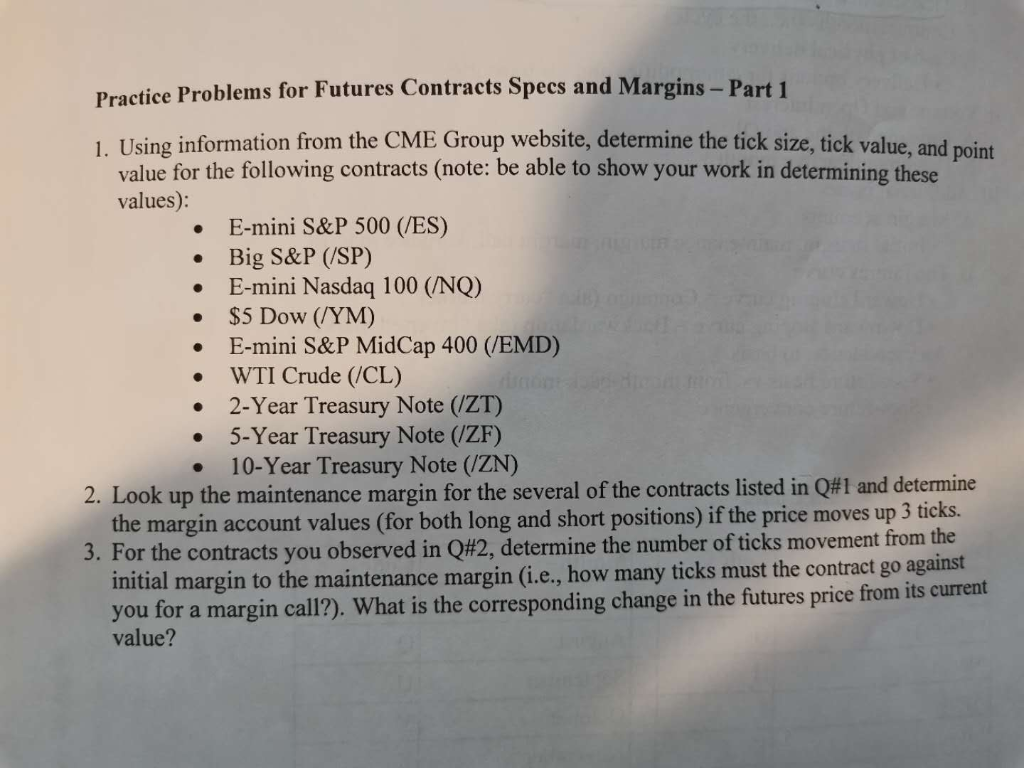

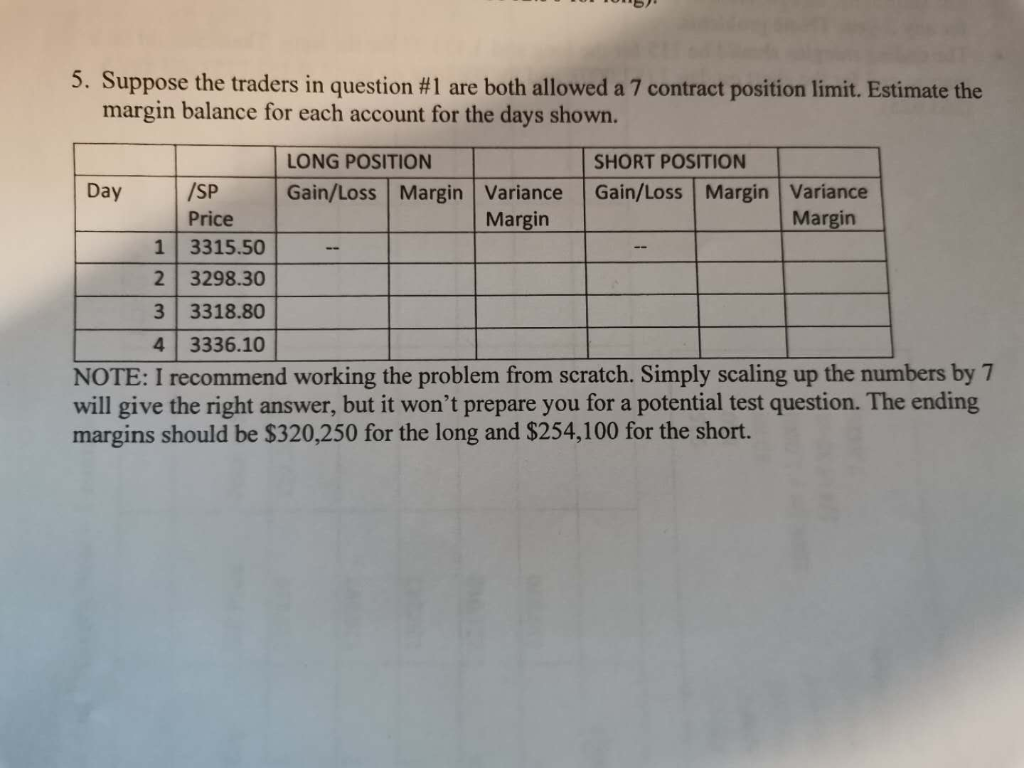

Practice Problems for Futures Contracts Specs and Margins - Part 1 1 Using information from the CME Group website, determine the tick size tiek ve value for the following contracts (note: be able to show your work in determining these values): E-mini S&P 500 (/ES) Big S&P (SP) E-mini Nasdaq 100 (NQ) $5 Dow (/YM) E-mini S&P MidCap 400 (/EMD) WTI Crude (CL) 2-Year Treasury Note (IZT) 5-Year Treasury Note (ZF) 10-Year Treasury Note (ZN) 2. Look up the maintenance margin for the several of the contracts listed in Q#1 and determine the margin account values (for both long and short positions) if the price moves up 3 ticks. 3. For the contracts you observed in Q#2, determine the number of ticks movement from the initial margin to the maintenance margin (i.e., how many ticks must the contract go against you for a margin call?). What is the corresponding change in the futures price from its current value? 5. Suppose the traders in question #1 are both allowed a 7 contract position limit. Estimate the margin balance for each account for the days shown. /SP LONG POSITION SHORT POSITION Day Gain/Loss Margin Variance Gain/Loss Margin Variance Price Margin Margin 13315.50 2 3298.30 3 3318.80 4 3336.10 NOTE: I recommend working the problem from scratch. Simply scaling up the numbers by 7 will give the right answer, but it won't prepare you for a potential test question. The ending! margins should be $320,250 for the long and $254,100 for the short. Practice Problems for Futures Contracts Specs and Margins - Part 1 1 Using information from the CME Group website, determine the tick size tiek ve value for the following contracts (note: be able to show your work in determining these values): E-mini S&P 500 (/ES) Big S&P (SP) E-mini Nasdaq 100 (NQ) $5 Dow (/YM) E-mini S&P MidCap 400 (/EMD) WTI Crude (CL) 2-Year Treasury Note (IZT) 5-Year Treasury Note (ZF) 10-Year Treasury Note (ZN) 2. Look up the maintenance margin for the several of the contracts listed in Q#1 and determine the margin account values (for both long and short positions) if the price moves up 3 ticks. 3. For the contracts you observed in Q#2, determine the number of ticks movement from the initial margin to the maintenance margin (i.e., how many ticks must the contract go against you for a margin call?). What is the corresponding change in the futures price from its current value? 5. Suppose the traders in question #1 are both allowed a 7 contract position limit. Estimate the margin balance for each account for the days shown. /SP LONG POSITION SHORT POSITION Day Gain/Loss Margin Variance Gain/Loss Margin Variance Price Margin Margin 13315.50 2 3298.30 3 3318.80 4 3336.10 NOTE: I recommend working the problem from scratch. Simply scaling up the numbers by 7 will give the right answer, but it won't prepare you for a potential test question. The ending! margins should be $320,250 for the long and $254,100 for the short

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts